Denver-based Hawkwood Energy, announced in early July of 2014 its entrance into the Eagle Ford with the acquisition of producing and non-producing assets in East Texas.

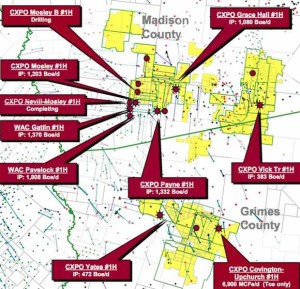

The deal includes 50,000 generally contiguous net undeveloped acres and approximately 1,800 b/d of current oil production, according to company officials. Development of the acquired assets has either targeted or will be prospective for the Eagle Ford Shale and Woodbine formations. The assets extend across Brazos, Leon, Madison and Robertson Counties.

Hawkwood acquired the assets in two separate transactions for undisclosed amounts from Crimson Energy Partners III and Encana Oil & Gas (USA) Inc. The deal with Crimson was mostly for acreage in Brazos County, and Encana's assets included in the transaction were located primarily in Robertson County.

“We are excited about the growing unconventional activity in the Eagle Ford and Woodbine, as well as the other long term multi-pay opportunities the area has to offer.”

Encana Divesting East Texas Assets

Encana has historically been a major industry player for natural gas production, but recently began selling many of its non-core assets to focus on liquids-rich shale fields. Some of those non-core assets were in East Texas, and in April of 2014, Encana announced the sale of approximately 90,000 net acres in Leon and Robertson Counties for $530 million. Company officials did not name a buyer for this transaction, and the deal is expected to close in the third quarter.

In June of 2014, Encana closed on its acquisition of 45,500 net acres in the oil window of the Eagle Ford in South Texas from Freeport-McMoran for $3.1 billion. This newly acquired acreage for Encana represents a new core area.

Read more: Encana Purchases Eagle Ford Assets from Freeport-McMoran - $3.1 Billion

Read more at hawkwoodenergy.com