BHP Billiton reported in February 2014 that portions of its Eagle Ford gathering system have been temporarily closed due to corrosion. The cause of the corrosion issue is at present being evaluated by the company. The gathering system closure was revealed in BHP's December 2013 financial report of Petrohawk. BHP is required to report operations updates and financial results to Petrohawk's debt holders, after acquiring the company in 2011.

Read more at bhpbilliton.com

BHP Eagle Ford Gathering Line Closure Operations Impact

According to BHP, production is continuing in the Eagle Ford, despite the interruption from the line closure. The company has increased the use of trucking to deliver product to market, and claims that there should be no significant impact on production.

BHP Eagle Ford Expenditures To Go Down in 2014

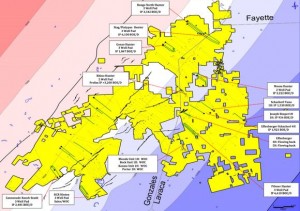

Onshore U.S. drilling and development cost BHP $2.4 billion in the second half of 2013. About 75% of this expense or $1.8 billion was spent in the Eagle Ford, mostly in the company's liquids-rich Black Hawk acreage. The company achieved a 72% increase in production for onshore US liquids in the second half of 2013, which was primarily attributable to the Black Hawk acreage.

In 2014, expenditures are expected to decrease in the second half of the financial year, following a 35% decrease in the company's active rig count to 26.

BHP Eagle Ford Highlights in Second Half of 2013

- Eagle Ford gathering line system closed due to corrosion

- BHP using trucks to deliver product to market

- $1.8 billion Eagle Ford spending in second half of 2013

- 72% increase in production for onshore US liquids

- Active rig count down to 26 - 35% decrease