SM Energy saw net production increases in both its' operated and non-operated acreage of 17% and 2% consecutively. In the second quarter of this year, SM Energy expects the drilling and completion carry provided under its acquisition and development agreement with Mitsui to be exhausted. SM Energy made this announcement in December 2013, when the company released it's 2014 capital budget.

In 2011, SM Energy entered a joint venture with Mitsui, whereby 39,000 net acres were sold to Mitsui for total commitments of $680 million (>$17,000 per acre).

Read more: SM Energy - Mitsui Reach Eagle Ford Shale JV Deal

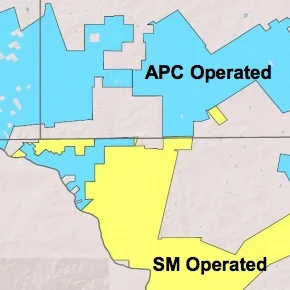

SM Energy Eagle Ford Operations Update (Non-Operated Acreage)

SM Energy's net production in its non-operated Eagle Ford acreage for the first quarter of 2014 averaged 23,400 boe/d. That's a 17% increase from the previous quarter, and a 46% increase compared to the first quarter of 2013. The operator made approximately 107 flowing completions during the first quarter.

SM Energy Eagle Ford Operations Update (Operated Acreage)

SM Energy's operated net production in the Eagle Ford shale averaged 76,300 boe/d in the first quarter of 2014, a 2% increase from the previous quarter. Average daily production in the first quarter of 2014 from the company's operated Eagle Ford shale program increased 47% compared to the first quarter of 2013.

During the first quarter, SM Energy made 20 flowing completions in its operated Eagle Ford Shale program. During the first quarter, the company's average lateral length of wells drilled was approximately 25% longer than the average length of wells drilled in 2013. The Company plans to complete these wells in the coming months, some of which will have modified completion designs.

SM Energy will be responsible for its' working interest share of proposed wells when the acquisition and development agreement terminates with Mitsui in the second-quarter. The company has budgeted approximately $250 million of drilling and completion capital for this program in 2014.

Read more at sm-energy.com