SM Energy sells 39,000 net acres to Mitsui for total commitments of $680 million (>$17,000 per acre). The full payment will be made in the form of a cost carry in which Mitsui will carry SM for 90% of its costs on the acreage until the $680 million is exhausted. Industry analyst have been waiting for announcements from SM Energy on how they would raise capital for development of their Eagle Ford Shale assets. The company is poised to double production for the entire company from the Eagle Ford alone. That doesn't come at a small price. Anadarko's JV with KNOC also raised eyebrows as SM Energy's non-operated position across that acreage was going to be a larger draw on the company's balance sheet.

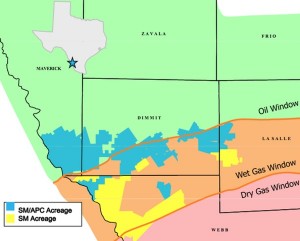

"SM Energy will have roughly 196,000 net acres in the Eagle Ford shale, of which approximately 75% will be operated by the Company, after this transaction and the previously announced divestiture of Eagle Ford assets in LaSalle and Dimmit Counties, Texas are consummated. The size and timing of these transactions vary from the assumptions made in the Company's issued guidance, as these transactions are expected to close later in the year than originally anticipated and SM Energy is retaining a larger position in the Eagle Ford than was originally assumed. As a result, reported production and capital expenditures for the year will exceed the Company's currently published guidance. The Company will provide full capital, production, and cost guidance updates for the remainder of 2011, as well as preliminary capital and production guidance for 2012 in its second quarter earnings release."

Read the full press release at sm-energy.com