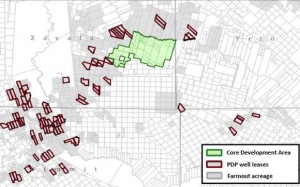

This week, U.S Energy Corp. provided its operations update for several of it's Zavala and Dimmit County wells targeting the Buda Limestone formation, which lies just underneath the Eagle Ford Shale. The Beeler #6H well, located in the company's Booth-Tortuga acreage block, was completed in March 2014, and had a peak early 24-hour flow back rate of 1,185 boe/d, with a 91% oil yield. The company has a 30% working interest and a 22.5% net revenue interest in 12,457 acres of the Booth-Tortuga acreage block. Contango Oil & Gas Company is the operator.

U.S. Energy Corp. also participates with U.S. Enercorp in approximately 4,243 gross (636 net) acres in the Big Wells acreage block in Dimmit County, TX. The leasehold is contiguous to the southwestern portion of the Booth-Tortuga acreage block.

“Having participated in six Buda wells with Contango and two with U.S. Enercorp., we are now beginning to gain a broader understanding of the extent of the play as well as the production response rates. Looking forward, we remain optimistic about the overall potential of the Booth-Tortuga and Big Wells prospects yet we still have much more drilling to do to fully understand the extent of the natural fractures in the region. Additionally, we believe that the potential exists to enhance the production profiles of our wells through down hole stimulation as warranted.”

U.S. Energy Corp. Buda Limestone Well Spud Dates

- Beeler #8H (Contango, Operator)

Spud on 2.06.14 - peak early 24-hour flow back rate of 886 boe/d; 30-day average production of 347 boe/d

- Willerson #2H (U.S. Enercorp, Operator)

Spud on 2.03.14 - peak early 24-hour flow back rate of 634 boe/d

- Beeler #6H (Contango, Operator)

Spud on 2.10.14 - peak early 24-hour flow back rate of 1,185 boe/d

- Beeler #5H ST (Contango, Operator) & Beeler Unit A #9H (Contango, Operator)

Spud on 3.25.14 and 3.26.14 respectively. Currently these wells are being drilled to their target depths.

Read more at usnrg.com