Matador Resources had a 76% increase in oil production across its portfolio in 2013 from 3,317 b/d - 5,843 b/d. The increase was a direct result of the company's drilling operations in the Eagle Ford Shale. In 2013, Eagle Ford production also contributed ~14.9 mmcf/d, which was ~42% of the company's total natural gas production.

Matador continues to have solid results in the Eagle Ford. Look for the company to make some acreage deals in the play this year.

Matador's Eagle Ford budget for 2014 is $318 million.

Read more: Matador Eagle Ford Capital Budget - $318 Million in 2014

Matador Eagle Ford Operations in 2013

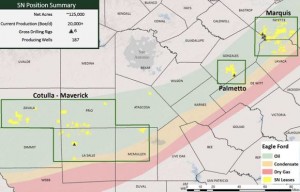

During 2013, Matador completed and began producing oil and natural gas from 32 gross (27.6 net) Eagle Ford wells, including 25 gross (25.0 net) operated and 7 gross (2.6 net) non-operated wells. In the fourth-quarter, the Company completed and began producing oil and natural gas from 9 gross (9.0 net) operated and 3 gross (1.1 net) non-operated wells.

Drilling and completion costs went down in 2013, and are connected to refinements in the company's fracking treatments.

“Drilling times and overall well costs have continued to improve in the Eagle Ford, and several recent wells on our western acreage in La Salle County in South Texas have been drilled in as few as eight days from spud to total depth with total drilling and completion costs at or below $6 million. The latest generation of our fracture treatment design, whereby we are pumping more fluid and more proppant while using more perforation clusters and tighter fracture spacing, is also resulting in better well performance, as compared to offsetting wells treated with earlier generation fracture treatment designs. Overall, our operations group is continuing to deliver better wells for less money in the Eagle Ford.”

Matador is also seeing positive results from downspacing. To date, the company has now drilled seven 40 to 50-acre spaced wells on its central acreage in Karnes County. Two of these wells flowed at approximately 1,100 to 1,200 boe/d (almost 90% oil), making them two of the best wells drilled by Matador in this area.

Read more at matadorresources.com