Sanchez Energy's proved reserves are up 178% from a little more than 20 million boe at year-end 2012 to 58.9 million boe at December 31, 2013.

Reserves increased as a result of successful development in the Eagle Ford and multiple acquisitions during 2013.

In the fourth quarter alone, Sanchez grew Eagle Ford production 60% over the third quarter to 18,810 boe/d. More impressively, the company increased production year over year by 905%.

Also read:Sanchez Energy Plans to Spend $600 Million in the Eagle Ford in 2014

[ic-l]A total 32 net wells were brought online in the fourth quarter 15 additional wells are in some stage of drilling and completion.

A strong fourth quarter puts the company is a great position to reach the high end or outperform guidance of 21,000-23,000 boe/d in 2014. Contributions from the Tuscaloosa are not accounted for in guidance, so success there will only increase the likelihood of the company outperforming guidance.

“2013 was a transformative year for the Company. Our production and reserves grew tremendously as a result of successfully executing our 2013 capital plan and completing several acquisitions.”

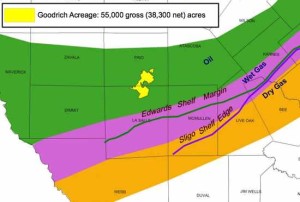

Sanchez Energy was busy in 2013. The company made several acquisitions to supplement its acreage in the Eagle Ford and stepped out of the play for the first time by acquiring acreage in the Tuscaloosa Marine Shale.

A few highlights from 2013 include:

- March 2013 - Sanchez Acquires Hess' Eagle Ford Assets for $265 Million

- July 2013 - ZaZa Sells Eagle Ford Assets to Sanchez Energy for $28.8 Million

- August 2013 - Sanchez Energy Pays $78 Million to Acquire 40,000 Net Acres in the Tuscaloosa Marine Shale

- September 2013 - Sanchez Energy Acquires Rock Oil's Eagle Ford Properties for $220 Million

- October 2013 - Sanchez Energy Increases Q3 2013 Production Seven Fold Over Q3 2012

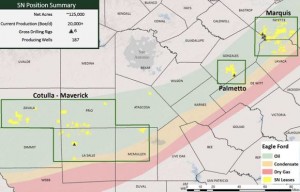

Drilling in 2014 will be focused on operated properties and the company is moving forward with development at 40-acre spacing in the Cotulla, Palmetto, and Wycross areas.

Read the full operational update at sanchezenergycorp.com