Goodrich Petroleum has planned for a capital budget of $175-$200 million in 2013. Of that, $115-137 million will be spent to drill 24-28 gross (16-19 net) wells targeting the Eagle Ford. The rest of the company's budget will be spent between the Haynesville Shale and Tuscaloosa Marine Shale plays.

Production growth will be mute as the company goes full force into its liquids producing plays. Natural gas volumes will decline and oil volumes are expected to roughly offset the decrease.

The top of guidance at $200 million is $50 million less than the company spent in 2012. Natural gas prices are taking a toll on budget in natural gas focused companies.

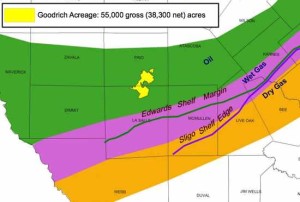

GDP Eagle Ford Operations Update

Average drilling days per well deceased by 40 percent sequentially in the quarter to 11 days for an average 6,000 foot lateral. Gross well costs for 2013 are projected to average $7.0 – $7.5 million for an average 6,000 foot lateral, which incorporates the lower well costs due to the faster drilling and cycle times achieved in the second half of 2012, as well as the reduced pressure pumping agreements in place for 2013. The Company currently plans to spud its initial Pearsall Shale test well in the first quarter.