Halcón Resources announced its 2014 results that included a net income for of $71.7 million and record production for its Eagle Ford operations.

Related: Halcón Resources Reduces 2015 Budget | Bakken Shale

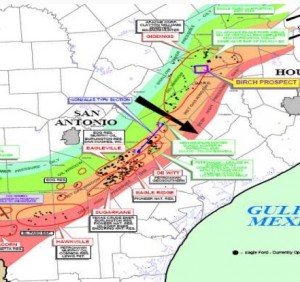

Halcón operations in the Eagle Ford saw a production growth of 136% year-over-year. The company operated an average of three rigs in El Halcón during the fourth quarter, but currently have only one rig running. For 2015 El Halcón drilling program will focus on capturing leases and holding acreage. Foremost, the company will focus on ways to reduce completed well costs.

Other 2014 highlights include:

- Q4 revenues of $239.5 million

- Revenues for the full year 2014 totaled $1,148.3 million, an increase of 15% compared to the full year 2013

- Q4 production was 46,076 barrels of oil equivalent per day (Boe/d) and 42,107 Boe/d, respectively

- Production was comprised of 81% oil, 9% natural gas liquids (NGLs) and 10% natural gas for the quarter and 83% oil, 7% NGLs and 10% natural gas for the year.

- Q4 operating costs per unit decreased by 23% compared to the same period of 2013

- Total operating costs per unit for the full year were $24.14 per Boe, representing a decrease of 17%

“We’ve reduced our 2015 drilling completion budget several times over the past few months. Service costs have come down significantly and continue to come down since the beginning of the year. Companywide, we currently have 26 operated wells being completed or waiting on completion. We’re operating three rigs, two in the Williston and one at El Halcón in East Texas.”

Halcón expects that completed well costs will decline by an additional 10% to 20% by midyear. In addition to across-the-board service cost reductions, they also plan to bring certain tasks in-house in order to reduce middlemen cost.

Read more at halconresources.com