Australian-based Austin Exploration saw good initial production (IP) rates from its' first Eagle Ford well with farmee partner

Halcón Resources in late March 2014 of 1,066 boe/d (87% oil). The well (Stifflemire #1H) was drilled to a total depth of 17,000 feet with an 8000 foot horizontal leg into the Eagle Ford Shale.

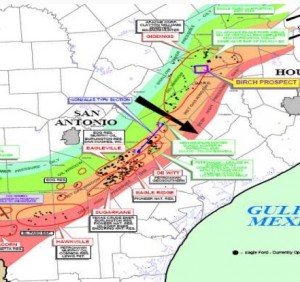

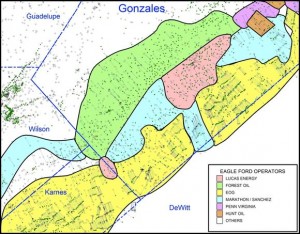

Austin Exploration entered the Eagle Ford in 2011, and in May 2013 announced a farm-out program with Halcón, whereby Halcón agreed to pay for the cost of three horizontal wells to earn a 70% interest in 4,400 acres of Austin's Birch Project. The cost to drill these wells is approximately $10 million per well.

“The oil flow from our first Eagle Ford well with Halcón gives confidence for our highest expectations for the future potential of the wider field which has the capacity for another 100 drilling locations. It proves the value we saw in this property when we acquired it in 2011. It also confirms the decision to bring world class operator Halcón to the project to advance the drilling program. The success at Eagle Ford will generate the revenue needed to fund the further development of our projects.”

In April 2014, Austin announced that drilling had begun on the second and third wells in tandem due to the good initial production rates from the Stifflemire #1H). The Kaiser 2H and the Nemo 1H well be drilled to a planned total depth of 17,500 feet with an 8,000 to 10,000 foot lateral.

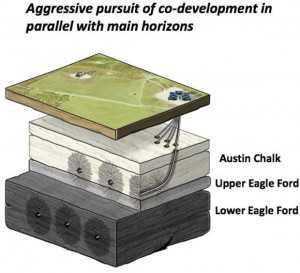

Austin has approximately 5,000 acres covering the Eagle Ford Shale formation in Burleson County, TX. The company is primarily targeting the Eagle Ford Shale and Austin Chalk, but is also prospective for the Taylor Sands, Buda Limestone and Georgetown formations.

Read more at austinexploration.com