Analysts have predicted that when the dust settles from plummeting crude prices, the real victims will be small energy companies. Big corporations have been slashing budgets to help them weather the storm, but smaller companies often don’t have the resources to carry them long term and it is beginning to show.

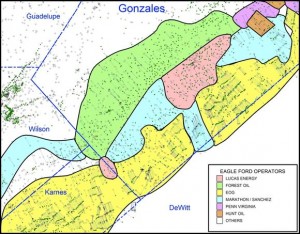

One such company is Lucas Energy, an Eagle Ford shale oil and gas exploration and production company located in Houston that maintains interests in over 10,000 acres in South and East Texas. Lucas has been scrambling to stay on top of its obligations and recently slashed its expenses by approximately $160,000 per month. But these efforts have not been enough to keep the company out of trouble. Last week, Lucas confirmed that they defaulted on a $7.7 million debt.

“The plunge in crude oil prices has required us to reconsider all alternatives. We are actively and aggressively pursuing options to secure funding through a corporate combination or project financing arrangement. We believe we have made significant progress toward establishing a definitive path forward. Management remains confident that a suitable solution will be agreed upon in the coming weeks and resulting public announcement at the appropriate time.”

Related: Lucas Energy Announces Eagle Ford Joint Venture

Related: Lucas Energy Farms Out Eagle Ford Acreage for $1 Million

A ‘suitable solution’ surfaced yesterday as the company announced it had executed a letter of intent for a proposed business combination with Victory Energy Corporation. This is the preliminary step to an official merger agreement that allows the companies to negotiate exclusively. Part of the agreement will be to provide for the capital necessary for Lucas to satisfy its obligations for its Eagle Ford wells, accounts payable and necessary working capital.

Read more at lucasenergy.com