In Marathon Oil's second quarter report released on Tuesday, higher density pad drilling and improved execution techniques were credited for a 55% quarter-on-quarter increase in gross operated wells turned to sales. The average time to drill an Eagle Ford well in the second quarter of 2014, spud-to-total depth, was 13 days - the company's goal for the year is 11 days.

Marathon's average net Eagle Ford production was 102,000 boe/d, representing an increase of 26% year-over-year and 6% quarter-on-quarter. Approximately 66% of net production was crude oil/condensate, 16% was natural gas liquids (NGLs) and 18% was natural gas.

Recently, Marathon sold its Norwegian assets for $2.7 billion to re-focus capital investments in the Eagle Ford Shale and other U.S. domestic assets. At the end of the second-quarter, Marathon had approximately $1.1-billion in E&P capital expenditures across its North American asset portfolio.

Read more: Marathon Oil Sells Norwegian Business to Focus on U.S. Assets

Marathon Eagle Ford Enhanced Completion Design

According to company officials, enhanced Eagle Ford completion design is delivering strong preliminary results. Wells with 180-day cumulative production are yielding on average 25% improvement relative to modeled type curves.

“We have high confidence in Eagle Ford volumes growth as our well results continue to outperform modeled type curves and deliver strong economics. This quarter we brought 76 gross operated Eagle Ford wells to sales. We expect that momentum to carry forward, generating double-digit production growth quarter-on-quarter in the Eagle Ford for the remainder of 2014.”

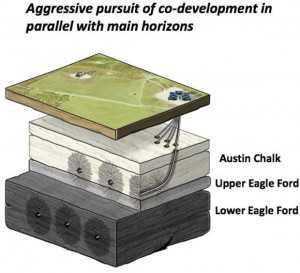

Marathon Austin Chalk/Upper Eagle Ford Update

Marathon Oil continued its successful delineation of the Austin Chalk/Upper Eagle Ford for co-development with an initial 15,500 net acres now delineated. During the second quarter, the company brought online three Austin Chalk/Upper Eagle Ford wells, including two in the condensate window: the Children Weston 4H and the Franke well, which had a 30-day initial production (IP) rate of approximately 1,650 boe/d (73% liquids). The third well with a 30-day IP rate of 600 boed (90% liquids) was the first in the black oil window. Nine additional Austin Chalk/Upper Eagle Ford wells are currently being drilled, completed or awaiting first production.

Read more at MarathonOil.com