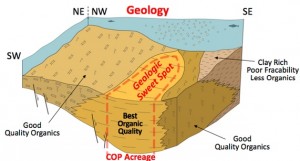

This week Houston-based oil giant ConocoPhillips (NYSE: COP) announced its 2015 capital budget of $13.5-billion, a decrease of 20% over 2014. It's a sign that major oil companies are taking lower oil prices seriously, but it doesn't change the company's focus in the Eagle Ford and Bakken Shale. In 2015, about $5.0 billion will be allocated toward development drilling programs, compared to $6.5 billion in 2014. According to COP officials, Lower 48 development program capital will continue to target the Eagle Ford and Bakken, while significant investment spending will be deferred in emerging North American unconventional plays, including the Permian, Niobrara, Montney and and Duvernay.

Conoco officials also indicated the budget decrease is reflective of lower spending on major projects, several of which are nearing completion.

“We are setting our 2015 capital budget at a level that we believe is prudent given the current environment,” said Conoco’s CEO Ryan Lance. “This plan demonstrates our focus on cash flow neutrality and a competitive dividend, while maintaining our financial strength. We are fortunate to have significant flexibility in our capital program. Spending on several major projects has peaked and we will get the benefit of production uplift from those projects over the next few years. In addition, we identified inventory in the unconventionals, where we also retain a high degree of capital flexibility.”

Despite the cut, the company expects to produce about 3% more in 2015 from continuing operations, excluding Libya.

Read more at ConocoPhillips.com