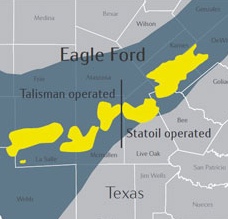

Eagle Ford player Goodrich Petroleum is considering selling all or a portion of its Eagle Ford Shale acreage in the first half of 2015. In early December of 2014, the Houston, TX-based company announced its Board of Directors had authorized management to "explore strategic alternatives" for the assets.

Goodrich, which has invested significantly in the Tuscaloosa Marine Shale (TMS) in South Louisiana and Mississippi, also announced its capex budget for 2015 this month at $150-million - $200-million. That's much less than the than $375-million budget the company projected in 2014, according to Goodrich's annual report. Company officials indicate about 95% of Goodrich’s 2015 budget will be earmarked for drilling in the TMS.

Read more: Goodrich Increases 2014 Budget by 50% and is Shifting to Tuscaloosa Marine Shale

Since June of 2014, the price of oil has dropped by nearly 50%, and Goodrich's pullback on capital investment is a strong indication of the impact of lower crude oil prices on shale oil operators. Company officials indicate a whole or partial sale of its Eagle Ford assets would significantly enhance the company's flexibility to further expand its development activities under better market conditions.

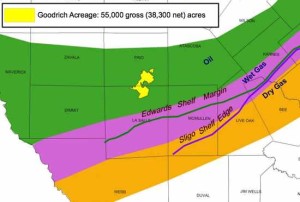

Goodrich has approximately 45,000 (30,000 net) acres in the Eagle Ford, with an estimated 383 (255 net) un-risked drilling locations remaining, according to company officials. Goodrich entered the Eagle Ford early in 2010, paying approximately $1,650 per acre.

We'll keep an eye out for any new details about Goodrich's potential exit from the Eagle Ford. Stay abreast of all EagleFordShale.com updates by subscribing to our newsletter.

Read more at GoodRichPetroleum.com