Talisman Energy Inc. and Statoil ASA have tabled plans to to sell their joint venture in the Eagle Ford Shale after offers came in lower than expected, Bloomberg reported in early July of 2014.

The companies were seeking around $4-billion for a 50-50 partnership, according to Bloomberg, which cited unidentified sources knowledgeable on the matter. Bids fell short in part because the venture produces especially light condensate, rather than crude oil, which commands more money, the article noted.

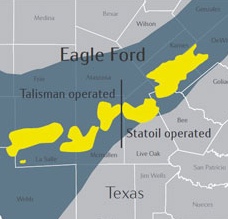

In June of 2013, our site reported (via Reuters) that Talisman Energy had retained the Royal Bank of Canada to determine if buyers were interested in the company’s Eagle Ford acreage. Talisman has approximately 70,000 net acres in the play according to a company spokesman.

Read more: Talisman Energy Shopping for Eagle Ford Buyers

Talisman said in March it plans to sell $2-billion of assets in 18 months to re-direct its focus on a smaller number of areas. In July of 2014, the company announced plans to unload its Australian operations.

Talisman and Statoil entered their joint venture in 2010. Last year, Statoil took over operations of the eastern portion of the JV. Statoil has approximately 73,000 net acres in the play.

Read more: Statoil - Talisman JV buys Enduring Resources Eagle Ford Acreage

Recent Eagle Ford Deal Closings

Recently, several other notable deals have closed as early Eagle Ford players cashed out on their investments in South Texas. Encana closed its acquisition of ~45,000 net Eagle Ford acres from Freeport McMoran on June 20, 2014 for $3.1 billion. Sanchez Energy also closed its $639 million deal with Shell for 106,000 net Eagle Ford acres on June 30th. Earlier this year, Devon Energy closed on its $6 billion Eagle Ford acreage acquisition with Geo Southern.

Read more: Eagle Ford Deal Closings

Read more: Devon Banking on High Returns from Eagle Ford Investment