Eagle Ford-focused Sanchez Energy reported record revenue of $151.7 million in the second quarter of 2014, with portfolio-wide production increasing 164% year-over-year to 20,437 boe/d.

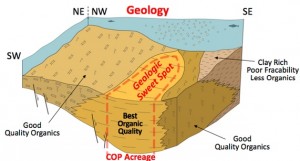

At the end of the quarter, the company closed its massive Eagle Ford acreage deal with Royal Dutch Shell for 106,000 net Eagle Ford acres in Catarina. The acquisition almost doubled the company's acreage in the play. Total purchase price for the acquisition was approximately $639 million, less approximately $85.5 million in normal and customary closing adjustments.

Read more: Sanchez Nearly Doubles Eagle Ford Acreage in $639 Million Deal with Shell

“As of August 1, 2014, Sanchez Energy has officially taken over all operations at Catarina after a brief transition period with Shell. The transition of operations has gone smoothly and the ramp up of Sanchez Energy operations is ahead of schedule. We have fully staffed our operations at Catarina and now have drilling, completion, and artificial lift installation in progress. Additionally, now that we have achieved critical scale from the Catarina assets, we are utilizing a dedicated frac spread as well as direct sourcing of chemicals and proppant. We expect these factors will reduce completions costs by an additional 30%, allowing flexibility to increase fracture stage size or improve returns from a lower development cost.”

With the Catarina acquisition, Sanchez increased its proved reserves 170% to approximately 117 MMBOE as of June 30, 2014. Crude oil constituted 49% and NGLs constituted 24% of the company's proved reserves. 56% of the company's proved reserves were classified as proved undeveloped, compared to 70% at same time last year.

Sanchez Eagle Ford Q2 Operations Update

Sanchez Energy currently has 6 gross rigs running across its Eagle Ford acreage, with 419 gross producing wells and 38 gross wells in various stages of completion.

By area, the company's Cotulla, Marquis, and Palmetto Eagle Ford operating areas comprised approximately 42% of the crude oil cut from total second quarter 2014 production volumes. Company officials expect the percentage of oil expected in the company's third quarter production volumes should decrease as the impact of the production volumes from Catarina are recorded.

The company's third quarter production guidance range portfolio-wide of 37,000 to 41,000 boe/d has been revised to 36,000 to 40,000 BOE/D while its fourth quarter production guidance range of 45,000 to 49,000 boe/d has increased to 48,000 to 50,000 boe/d. Production guidance for 2015 remains the same at a range of 53,000 boe/d to 58,000 boe/d.

Read more at sanchezenergycorp.com