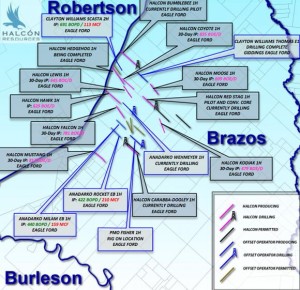

Halcon Resources set an initial production record from an Eagle Ford well in Brazos County that is a five mile step out from the nearest producing well. The Stasny-Honza 1H came online producing 1,262 boe/d.

Halcon has three rigs working in the area and plans to have four rigs active through 2014. The company spudded 13 wells and brought 19 wells to production in the third quarter. Net production from the area grew to 6,500 boe/d from 31 wells during the quarter. Eight wells are waiting to be completed and three wells are being drilled.

“Third quarter results were defined by continued expansion of our activities in the Williston Basin, El Halcón and other areas.”

The company continues to work toward and optimal drilling and completion combination. The average time from spud-to-total depth decreased to 14.4 days during the quarter and the average drilling cost per foot decreased 19%. A company record was set by drilling a well with an 8,000 ft lateral in 7.3 days.

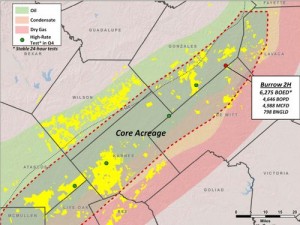

Halcon is closing in on its target of leasing 100,000 net acres in the area. The company has secured leases or commitments on 90,000 plus acres to date.

Company-wide more than 40% production growth is expected in 2014. Read the full release at halconresources.com