EXCO Resources completed the acquisition of Eagle Ford assets in the third quarter and ended September producing approximately 7,600 boe/d from the play.

Immediately following the Chesapeake deal, the company sold a 50% interest in the undeveloped portion of acquired assets to KKR for $131 million, so the two are partners with CNOOC in the Eagle Ford.

EXCO, as the operator, plans to run 4-5 rigs in full development mode and expects to drive down costs by leveraging what the company has learned through its "manufacturing" approach in other shale plays.

“Our acquisitions in the Haynesville and Eagle Ford shales support our strategy to grow in our core areas, add to our oil production, and use our outstanding operating expertise. We have begun our development program in the Eagle Ford through the drilling partnership with KKR. Our early drilling and completion results are meeting our expectations, and we plan to quickly implement a manufacturing program on both the Eagle Ford and Haynesville assets.”

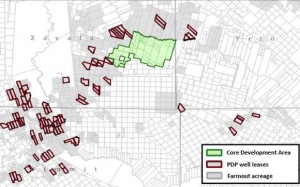

EXCO acquired 55,000 net acres from Chesapeake in July and entered a farm out agreement on another 147,00 acres.

EXCO then sold a 50% interest in the undeveloped acreage to KKR for $131 million. KKR owns half of the acquired interest in undeveloped properties and EXCO will assign half of its remaining interest to the company as each well is drilled. KKR will fund and own up to 75% of each well and EXCO will fund and own 25%. EXCO then has the right to purchase wells in batches from KKR starting in the first quarter of 2015.

Read the full press release at excoresources.com