Petrohawk's Eagle Ford position is paying off in a big way. The company has received a bid to be acquired by BHP Billiton for a 65% premium over the prior days stock price. Petrohawk's leading position in the Eagle Ford is likely a primary driver behind the acquisition. The company is strategically positioned in two of the hottest areas of the Eagle Ford with its Black Hawk and Hawkville field positions. The company also has a sizeable oil position at the Red Hawk Field in the Eagle Ford Shale Oil window that has not provided the economic results needed to compete for capital with Petrohawks other assets. Expect the Red Hawk Field to get more attention now that the operator has much deeper pockets. Overall, drilling rates across Petrohawks asset base will likely increase as BHP looks to accelerate value from its newly acquired assets.

That's a hefty price but BHP needs the people and the assets. After several failed bids to consolidate in the mining industry, the company turned to investing in oil & gas exploration and production.

The Petrohawk acquisition follows BHP's $4.75 billion acquisition of Chesapeake's Fayetteville Shale assets. BHP only got the assets in the Chesapeake deal, so over the next year the company was tasked with building a large US E&P business. The Petrohawk acquisition gives them the human capital and just happens to be a company that was a leader in the Fayetteville Shale before divesting assets to focus in the Haynesville Shale and Eagle Ford Shale.

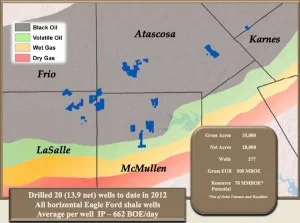

BHP gets Petrohawk with its three core positions which include 225,000 acres in the Haynesville Shale, 120,000 net acres in the Lower Bossier Shale, 332,000 acres in the Eagle Ford Shale, and 325,000 acres in the Midland/Delaware basins, which is prospective for the Avalon Shale, Bone Springs, and Wolfcampian formation.

Combined with the Chesapeake deal, BHP will become one of the top ten natural gas producers in the US. The company's onshore US operations will include almost 1,500,000 net acres that produce over 1.3 Bcf per day.

BHP Billiton [ASX: BHP, NYSE: BHP, LSE: BLT, JSE: BIL] and Petrohawk Energy Corporation (“Petrohawk”) [NYSE: HK] announced today that the companies have entered into a definitive agreement for BHP Billiton to acquire Petrohawk for US$38.75 per share by means of an all-cash tender offer for all of the issued and outstanding shares of Petrohawk, representing a total equity value of approximately US$12.1 billion and a total enterprise value of approximately US$15.1 billion, including the assumption of net debt. The Petrohawk board of directors has unanimously recommended to Petrohawk shareholders that they accept the offer.

The transaction would provide BHP Billiton with operated positions in the three world class resource plays of the Eagle Ford and Haynesville shales, and the Permian Basin. Petrohawk’s assets cover approximately 1,000,000 net acres in Texas and Louisiana, with estimated 2011 net production of approximately 950 million cubic feet equivalent per day (MMcfe/d), or 158 thousand barrels of oil equivalent per day (Mboe/d). At year-end 2010, Petrohawk reported proved reserves of 3.4 trillion cubic feet of natural gas equivalent (Tcfe). The company has a current non-proved resources base of 32 Tcfe for a total risked resource base of 35 Tcfe. Petrohawk reported gross assets of US$8.2 billion as at 31 March 2011 and US$390 million of profit before tax for the year ended 31 December 2010.