Matador Resources priced a public offering of 8.5 million shares at $15.25/share or for total proceeds of near $130 million on September 4, 2013. The capital raised will be used to fund the company's capital budget and acreage acquisitions in its core operating areas.

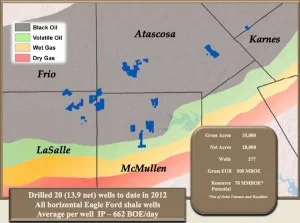

Approximately 78% of Matador's 2013 capital budget is allocated to the Eagle Ford. Two rigs will run in the region throughout 2013 and one rig will be added in the Permian Basin of West Texas.

Matador also intends to use net proceeds from this offering to fund the acquisition of additional acreage in the Eagle Ford shale, the Permian Basin and the Haynesville shale and for other general working capital needs.

Read the full press release at matadorresources.com