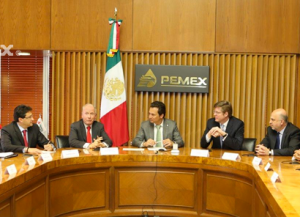

Petróleos Mexicanos announced Friday that is has acquired the funding to complete the construction of the pipeline Los Ramones II for an estimated $900 million.

The deal was a collaboration between Blackrock and First Reserve will be one of the first projects for Mexico’s historic energy reform that will enable a low-cost energy supply and create jobs. The first part of this project, the Ramones I, ranges from Eagle Ford in Texas to Los Ramones, Nuevo León and phase II will reach Guanajuato to supply the central and western parts of the country.

“Participation of the private sector in infrastructure will be very important in Mexico, and around the world. Given the recent reforms, growth in Mexico and economic stability, investment opportunities in Mexican infrastructure have definitely drawn our attention and we hope to explore other opportunities in the near future.”

The terms of the deal commit BlackRock to $4.6 billion and First Reserve to $30 million over 25 years and gives them a combined 45 percent control of the project.

Related: Eagle Ford Shale in Mexico Needs Private Investment

Mexico’s rising demand for natural gas has created a lucrative export industry for Eagle Ford producers in recent years. The country hopes to lessen its dependence on other sources by tapping into its own shale oil and natural gas within the next five to 10 years.

Read more at pemex.com