NET Midstream has received FERC approval for border crossing facilities that will allow the NET Mexico Pipeline to export Eagle Ford natural gas to Mexico. At capacity, the pipeline could double U.S. natural gas exports to Mexico.

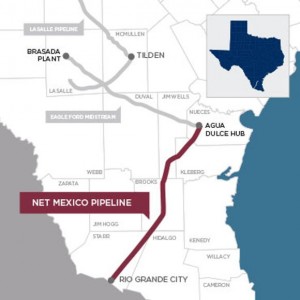

The Net Mexico pipeline is a 42-inch, 124 mile pipeline from Nueces County to Starr County in South Texas.

The pipeline is backed by a 2.1 Bcfd transportation contract with MGI Supply ltd (PEMEX Subsidiary).

Read - Net Midstream Plans Eagle Ford Pipeline from Mexico to Nueces County

“We were pleased to receive this timely authorization from FERC last week. Receipt of the Presidential Permit was an important regulatory milestone for NET Mexico.” said Joe Gutierrez, Co-President of NET. “Development and financing of the pipeline is on schedule, with mainline construction beginning in the first quarter of 2014, and mechanical completion in October.”

Much of the pipeline will be 42 inch pipe, but approval has been granted for a 48-inch pipeline into Mexico.

Read the full press release at netmidstream.com