Sanchez Energy increased its' portfolio-wide production by 376% to 18,784 boe/d in the first-quarter of 2014 over the first-quarter of 2013. The oil cut from this year's first-quarter production was 72%, with 15% NGLs and 13% natural gas. Production remained relatively flat quarter-over-quarter.

Read more: Sanchez Energy's Reserves Near 60 Million Barrels - Production Surges in Q4

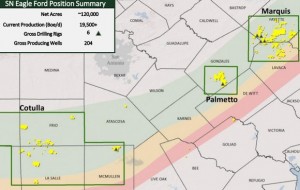

The company's current production of 21,000 boe/d is within guidance for 2014. Operations are incorporating more pad drilling, which company officials credit for current production numbers and cost savings.

“Our ability to more than triple our first quarter production year over year reflects positively on both the quality of our assets and the efficiency of our operations. Moving forward, we will continue to leverage our proprietary systems and drilling processes to drive down costs per well, reduce drill time and enhance our capital efficiencies. This strategy already has effectively reduced drill time by 40%, doubled the number of frac stages pumped per day and decreased total well costs by 30% across our Eagle Ford operations.”

Sanchez Energy Eagle Ford Operations Update

Sanchez currently has six rigs running in the Eagle Ford, with 214 gross producing wells. 13 gross wells are undergoing or awaiting completion.

- Marquis Project - 48 gross producing wells, 8 awaiting/undergoing completion

- Palmetto Project - 57 gross producing wells, 3 awaiting/undergoing completion

- Cotulla Project - 93 gross producing wells

- Wycross Project - 16 gross producing wells, 2 awaiting/undergoing completion

At the beginning of April 2014, the company's Marquis project area (~69,000 net acres) had 7 wells awaiting or undergoing completion. Sanchez continues to monitor production in the lower Eagle Ford section of its' Sante-area wells in Fayette County, and plans to shift some of its' focus to other horizons, including the upper Eagle Ford and Austin Chalk in the greater Sante area. Company officials say expectations are positive for additional resource potential from these other horizons.

In the company's Wycross project area , a multi-well pad program in the first quarter lowered drilling costs to $3 million versus the previous operator's average cost of $3.3 million. The last well on this pad is expected to have a drilling cost of below $3 million according to company officials.

Read more at sanchezenergycorp.com