EOG Resources announced impressive results from the first quarter. The company's Eagle Ford wells just keep getting bigger.

A total of 18 wells produced more than 2,500 b/d of oil and nine more wells produced more than 3,500 b/d of oil. That's 27 wells that came online at rates greater than 2,500 b/d!

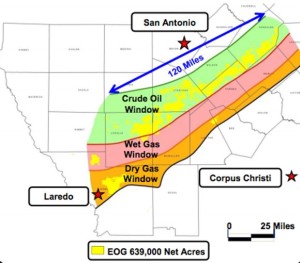

Stellar well performance has led to an increase in planned development in 2013. EOG now plans to drill 425 net wells compared to 400 planned previously.

Results from the Eagle Ford helped fuel company-wide crude oil production growth of 33% year-over-year.

"Our first quarter results clearly demonstrate EOG's ability to consistently execute a highly efficient crude oil drilling program while simultaneously trimming costs and continually making better wells," Papa said. "To further fuel EOG's momentum, we are channeling as much capital as possible into our high rate-of-return oil plays this year."

EOG is entering what it deems a period of "manufacturing-type" development that will drive down costs, while pursuing the most effective completions. Current development is planned at 40-65 acre well spacing. The company plans to add even more wells in 2014 if oil prices hold at current levels or better.

“Based on confidence in its current asset base and multi-year inventory of drilling locations, EOG is targeting sustained peer-group leading high growth rates of crude oil production for the 2013-2017 period, provided WTI prices remain at or above the mid-$80 level.”

Notable EOG Wells In Gonzales County

[ic-r]

- Guadalupe Unit #01H, #02H, #03H, #04H, #09H, #10H, #11H and #12H had initial rates ranging from 2,175 to 4,490 Bopd with 265 to 630 barrels per day (Bpd) of natural gas liquids (NGLs) and 1.5 to 3.6 million cubic feet per day (MMcfd) of natural gas

- The Lepori Unit #1H, #2H and #3H, which flowed at initial production rates of 3,490, 3,900 and 3,880 Bopd with 530, 585 and 590 Bpd of NGLs and 3.0, 3.4 and 3.4 MMcfd of natural gas, respectively

- The Lefevre Unit #1H and #2H had initial crude oil production rates of 3,195 and 3,180 Bopd with 425 and 525 Bpd of NGLs and 2.4 and 3.0 MMcfd of natural gas, respectively

- The Otto Unit #4H, #5H and #6H were completed to sales at 3,915, 3,125 and 3,485 Bopd with 570, 485 and 555 Bpd of NGLs and 3.3, 2.8 and 3.2 MMcfd of natural gas, respectively.

Notable EOG Wells In Karnes County

- The Wolf Unit #1H and #2H, in which EOG has 100 percent working interest, began sales at 5,380 and 4,475 Bopd with 400 and 500 Bpd of NGLs and 2.3 and 2.9 MMcfd of natural gas, respectively

- The Lazy Oak Unit #4H and #5H went to initial production at 2,025 and 2,680 Bopd with 170 and 240 Bpd of NGLs and 1.0 and 1.4 MMcfd of natural gas, respectively

- The Korth Unit #1H and #2H, which were completed to sales in January at 3,980 and 3,580 Bopd with 415 and 450 Bpd of NGLs and 2.4 and 2.6 MMcfd of natural gas, respectively.