A Texas A&M economist met with business leaders to share his projections of how long the Eagle Ford shale boom will last. He expects the play will have a productive lifespan of 16 years. I'd like to see what is behind the 16 year number, but I believe the message was well delivered. This Eagle Ford development isn't going to fizzle out any time in the near future. The opportunity is too big. Billions of barrels of oil & gas resources mean billions and possibly trillions of dollars in economic development.

The economist speaking at the 2013 Executive Economic Outlook breakfast was simply conveying there is significant opportunity in South Texas. Most real estate developers are being cautious and not making commitments unless they can project a one-year payout. If the play has a lifespan of decades, more permanent developments are needed. South Texas will need every thing from grocery stores to home developments, gas stations and Wal-Marts.

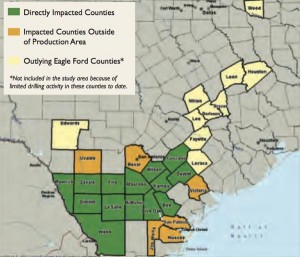

Eagle Ford Shale's Lifespan

[ic-r]The Eagle Ford is still relatively young, so everyone is wondering if the play will go bust. The answer to that question lies in the future oil price. As long as oil prices hold steady at a level of more than $70, South Texans don't have much to worry about. The Eagle Ford returns more to operators than almost all plays in the country. Even if oil prices drop, it will still have the same relative position as the investment of choice in North America.

An old industry addage is "The easiest place to find hydrocarbons is where you've already found them". That will likely prove true in South Texas. We're actually seeing it play out today. Operators have new development plans in several other oil & gas plays including the Austin Chalk, Buda, Escondido, Olmos, and Pearsall Shale formations.

I wouldn't say never, but I'd place the probability of a bust in South Texas lower than anywhere else in the country.