Rosetta Resources will spend approximately tw0-thirds of its $1.1 billion budget in 2014 in the Eagle Ford.

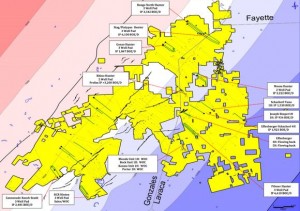

The company will spend $735 million running 4-5 rigs, with plans to drill and complete 90-95 gross wells. Approximately half of the activity will target the Eagle Ford from the company's Gates Ranch leases.

Read more:Rosetta Acquires Additional Eagle Ford Interests at Gates Ranch

As a result of Eagle Ford and Permian Basin growth, Rosetta expects production to grow 20-30% to 60,000-65,000 boe/d.

“The 2014 capital plan is structured to deliver between 20 and 30 percent combined production growth from our Eagle Ford and Delaware Basin assets. The program reflects increasing activity as we initiate broader scale horizontal development in Reeves County and further expand development in new areas of our current Eagle Ford position,” said Jim Craddock, CEO. “We will continue to focus our efforts on integrating our West Texas assets while continuing to efficiently execute the development of our Eagle Ford leases.”

Rosetta will run six rigs and spend $265 million in the Permian Basin in 2014.

Also read:Rosetta Has Yet To Complete 23% of Its Eagle Ford Wells

Fourth Quarter Operational Delays Impact Production

Rosetta's fourth quarter 2013 production was negatively affected several issues that are estimated to have lowered production by ~4,000 boe/d. Rosetta expects fourth quarter production will average 52,000 boe/d and full-year 2013 production will average 50,000 boe/d.

- Operational issues on a third-party gathering system

- Operational issues at a third-party processing plant

- Wells shut-in due to adjacent well completions

- Rosetta compressor station fire

Jim Craddock, CEO, commented, "Our strength is our people and our personnel have done a great job of minimizing the impacts of several external hurdles we faced this quarter. We look forward to discussing our fourth quarter results, as well as our outlook for 2014, with investors in February."