Memorial Production Partners announced in March 2014 that it purchased Eagle Ford assets from Alta Mesa Holdings for $173 million. The deal includes 15,200 (800 net) acres in Karnes County, with 99-percent of the assets already held by production.

According to company officials, Memorial will gain an interest in 117 non-operated wells, with average net production of 1,650 boe/d. Approximately 80-percent of current production is oil.

Additionally, Memorial is acquiring a 30-percent interest in Alta Mesa's Eagle Ford leasehold, which includes an interest in over 180 gross and 9 net proved developed non-producing and proven undeveloped locations. Murphy Oil Corporation is the primary operator of the acquired properties.

Read more: Murphy Oil's Eagle Ford Production Grows to 39,000 boe/d in 2013

“This acquisition is consistent with our strategy of acquiring reserves in proven basins with long lives and high margins. Further, this acquisition provides an entrance into one of the country’s premier resource plays in a structure appropriate for an MLP and an opportunity to partner alongside a top operator like Murphy Oil.”

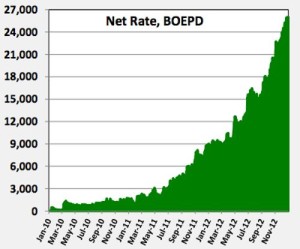

Murphy Oil Company continues to grow steadily in the Eagle Ford. At the end of 2013, the company grew production in the play to 39,000 boe/d in the play.

Memorial and Alta Mesa are both based in Houston, TX. Alta Mesa began acquiring assets in Karnes County in 2010, and will retain a 50-percent net profits interest in the proved developed producing wells included in the sale as of January 1, 2014. At year-end 2014, 2015 and 2016, the net profits interest will automatically reduce to 30-percent, 15-percent and 0-percent, respectively.

Read more at memorialpp.com