Sanchez Energy has raised it's Eagle Ford production exit rate guidance to 15,000-17,000 boe/d for 2013. Capital expenditures have also been revised to $475 million compared to $347 million previously.

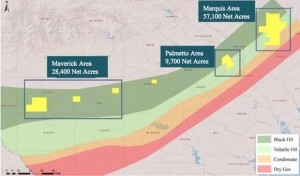

The big increase is due to the purchase of 43,000 net acres from Hess. The deal closed on May 31, 2013, with a price tag of ~$280 million. Read more about the deal in the article: Sanchez - Hess Reach Eagle Ford Deal For $265 Million

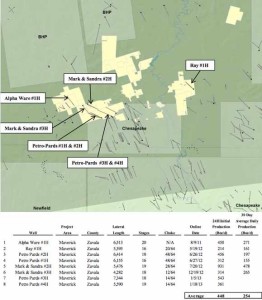

Over 90% of the $475 million capital budget will be spent drilling and completing 65 gross (46.7 net) wells. Ten of those wells will be directed at the newly acquired Cotulla assets.

Tony Sanchez III, President and Chief Executive Officer of Sanchez Energy, commented: "As a result of the closing of our Cotulla asset acquisition and an updated review of our operational opportunities, we have increased our 2013 capital program and activity levels.

Sanchez is also increasing its development plans in the Palmetto area in Gonzales County, TX, after realizing better well results than expected. A total of 9 gross (4.5 net) more wells will be drilled in the area. That brings the total number of planned wells in the Palmetto area to 34 gross (17 net) this year.

Sanchez will run three rigs in the Palmetto area in the second half of the year.

Read the full press release at sanchezenergycorp.com