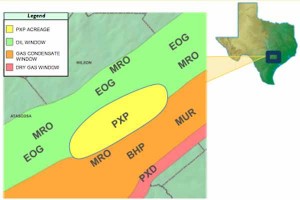

Freeport McMoRan Copper & Gold (FCX) announced plans to acquire Plains Exploration & Production (PXP) and McMoRan Exploration (MMR) on December 5, 2012. FCX will pay $6.9 billion (24% premium) for Plains E&P and will pay $2.1 billion (74% premium) for McMoRan Exploration. FCX said it is bullish natural gas prices post 2013, but will have to make good investment decisions with the amount of debt that will be carried. The company is combining the Gulf of Mexico interests of the two companies, gets long-lived assets in California from PXP, and gains exposure to the Eagle Ford Shale.

In the Eagle Ford, Plains Exploration has:

- 22 million boe of proved reserves

- 172 million boe of published resource potential

- 60,000 net acres

- 500 future well locations

- James C. Flores, Chairman and Chief Executive Officer of PXP said:

“I am proud of the accomplishments of our team who have built a strong company and created the opportunity for our shareholders to participate in this exciting transaction. I believe that the addition of PXP’s U.S. oil and gas assets to FCX’s global mining business will establish a very significant, long-term commodities business positioned to generate meaningful returns over an extended period...”

Read more about the deal at FCX.com

[ic-c]