Several significant Eagle Ford acquisitions were announced in April and May of 2014. In June of 2014, the details of these acreage deal closings were announced by the buyers, which included Encana Corporation, Sanchez Energy, Panhandle Oil & Gas and Warwick Energy.

Encana Corporation

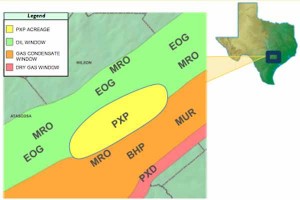

The Encana deal was by far the largest. The company completed its acquisition of ~45,000 net Eagle Ford acres located in the oil window of Karnes, Wilson and Atascosa Counties from Freeport McMoran on June 20, 2014 for $3.1 billion.

In the first quarter of 2014, the acreage produced 53,000 boe/d. Company officials estimate a drilling inventory of more than 400 locations. The company plans to update its production guidance in its next quarterly report on July 24, 2014.

Read more about the deal: Encana Purchases Eagle Ford Assets from Freeport McMoran

Sanchez Energy

Sanchez Energy announced on June 30, 2014 that it closed its massive Eagle Ford acreage deal with Royal Dutch Shell for 106,000 net Eagle Ford acres.

Total consideration for the acquisition was approximately $553.5 million, comprised of the $639 million purchase price less approximately $85.5 million in normal and customary closing adjustments. The transaction was funded from cash on hand from a portion of the net proceeds from the company's previously issued $850 million senior unsecured 6.125% notes due in 2023.

Read more about the deal: Sanchez Nearly Doubles Eagle Ford Acreage in $639 Million Deal with Shell

Panhandle Oil & Gas

Panhandle Oil & Gas announced the closing of its Eagle Ford acquisition on June 17, 2014. The deal includes a 16% non-operated working interest in a 11,100 leasehold acres (1,775 net) block that company officials say is held largely by production with 63 producing wells.

Net to the company's interest, May 2014 production in the newly acquired acreage was 825 boe/d , with an 80% oil cut. The property is currently being developed with a one drilling rig program by the operator, Oklahoma City-based Cheyenne Petroleum Company.

Read more about the deal: Panhandle Oil and Gas Acquires Interest in Eagle Ford Acreage for $80 Million

Warwick Energy

Read more about the deal: Warwick Energy Buys Eagle Ford's R/C Sugarkane for Undisclosed Amount

Closing details: Warwick Energy Closes Deal for 7,300 Net Eagle Ford Acres