Eagle Ford spending could stretch to new heights this year.

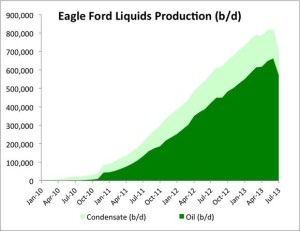

Eagle Ford oil production will surpass 1 million b/d early this year (combined oil and condensate production already has) and strong growth won't stop there.

GlobalData expects development spending could reach as high as $30 billion. If that happens, Eagle Ford oil production won't just reach 1 million b/d, it'll blow right past it. Other research organizations estimate spending somewhere in the $20-25 billion range.

If spending ends up closer to $20 billion, it will tie directly to cost savings the industry is capturing across the board and not necessarily due to less activity.

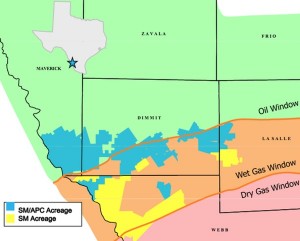

“With over 250 rigs operating in Eagle Ford, companies are expected to spend approximately $30 billion in capital this year, and nearly all of the major operators are projecting at least five years’ more drilling at the current rapid pace. The most efficient operators in sweet spots are achieving over 100% pre-tax Internal Rates of Return (IRR) with conservative pricing.”

Read more from globaldata.com