Eagle Ford Shale drilling increased 11 rigs to jump back to 270 units drilling in the region. Growth was largely attributable to La Salle (35 rigs) and Karnes (36 rigs) counties. 270 rigs puts the region back at the average rig count for 2012. Earlier in the year, I noted the Eagle Ford rig count would likely decline (Here) throughout the remainder of the year if oil prices didn't go above $100. I was wrong. Many of the major operators have dropped rigs as they have reached certain milestones in drilling time, but others have stepped in. As the most efficient operators dropped rigs, they were almost simultaneously being picked up by other companies in the play.

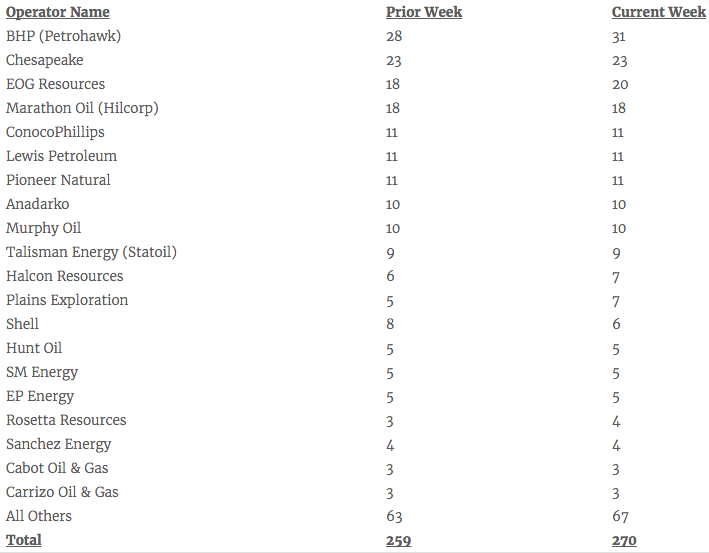

In the second half of the year, we've seen Chesapeake and EOG drop 10 rigs or more each, but Marathon and BHP (Petrohawk) have added almost enough rigs to offset those declines. Then there are the small and mid-size operators who are adding a rig at a time in support of regional development. What I thought would be an overall decline in active rigs has turned out to be a non-event.

Eagle Ford Oil & Gas Rigs

The natural gas rig count grew to 57 on the week. Natural gas prices reached a 2012 high on Friday when the commodity was traded $3.80 per mmbtu. The worries of natural gas storage being pushed to a maximum have been relieved and the price will be very much dependent on weather in the coming months.

The oil rig count gained back its losses from last week to settle at 213 running. WTI crude futures were almost unchanged for the third week in a row. Oil was trading at ~ $87 per barrel on Friday. Eagle Ford crude priced at $97/bbl on the 15th of November. Light crude and condensate in the area traded at $82 and $81, respectively.

There are 256 horizontal rigs running in the region. Karnes County leads development with 36 rigs running. La Salle with 35 rigs, McMullen (29), Webb (26), Dimmit (21), Gonzales (22), DeWitt (19), Live Oak (13), Atascosa (9), Fayette (8) and Lavaca (8) round out the top Eagle Ford counties.

Oil & gas news items this week included:

- NuStar - TexStar Agree to $425 Million Eagle Ford Midstream Deal

- Abraxas Petroleum is Selling Eagle Ford Acreage for $20 Million

- New Texas RRC Eagle Ford Well Map

- Rosetta is Proving the Potential of Central Dimmit County

Devorah Fox of Mike Byrnes & Associates contributed great article discussing the Steps in Planning a Safe Heavy Load Haul.

Be sure to visit our South Texas Oilfield Job Listings to search openings and come back weekly for updates or sign up for alerts.

Eagle Ford Rig Count by Operator

What is the Rig Count?

The Eagle Ford Shale Rig Count is an index of the total number of oil & gas drilling rigs running across a 30 county area in South Texas. The South Texas rigs referred to in this article are for ALL drilling reported by SmithBits and not solely wells targeting the Eagle Ford formation. All land rigs and onshore rig data shown here are based upon industry estimates provided by the Baker Hughes Rig Count and/or Smith Service Co's (Schlumberger) Smith Rig Count.

Eagle Ford Shale Drilling by County