Cabot Oil and Gas reports strong results from their Eagle Ford assets during the first quarter of the year, boasting good returns and reduced costs.

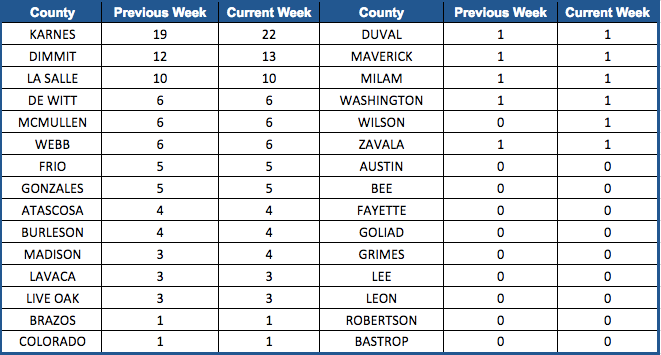

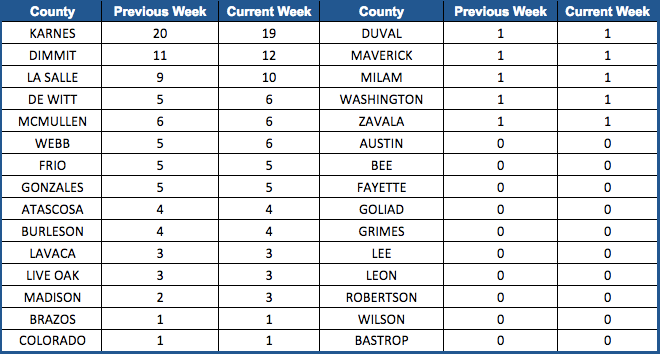

Related: Eagle Ford Rig Count on the Move!

Cabot released first quarter results this week showing a positive reversal since last year. The company reported a net income of $106 million for the first quarter of 2017 compared to a loss of $51 million during 2016 Q1.

2017 First Quarter Highlights

- $106 million net income

- 7% increase in daily production

- 11% decrease in operating expense per unit

Eagle Ford Operations

Cabot's net production in the Eagle Ford Shale during the first quarter of 2017 was 12,059 barrels of oil equivalent (Boe) per day, an increase of 15 percent form the last quarter. The company raised its 2017 E&P capital budget to $845 million and plans to spend $200 mm for development activities in the Eagle Ford Shale.

Other highlights include:

- 7 net wells drilled and completed

- 10 net wells placed on production

- Drilling costs were 13 percent lower, compared to the full-year 2016 average

- Currently operating one rig

- Utilizing one completion crew

“Our Eagle Ford has improved (...), our efficiency, our cost of business, cost of operations, the return that we are able to deliver and the strip pricing that we have out there right now. We’re getting good returns in our Eagle Ford operation. ”