Oil and gas production for the state of Texas is at its lowest levels in years, according to preliminary data from the Texas Railroad Commission.

Read moreSanchez Gains Eagle Ford Assets for $2.1 Billion

Sanchez Energy $2.1 Billion Deal

Sanchez Energy Corporation has completed the purchase of 318,00 acres in the Eagle Ford.

Related: Sanchez Production Partners Gain Eagle Ford Assets

Sanchez announced last week it closed on a $2.1 billion deal with Anadarko Petroleum through a 50/50 partnership with Blackstone Energy Partners.

The 'Comanche Transaction' is expected to increase Sanchez' total net proved reserves to approximately 340 MMBoe, a 78% increase from year-end 2016 reserves. The company plans to focus initially on completing the 132 gross drilled but uncompleted wells currently in the acreage.

“With the closing of the Comanche Transaction, the Company’s operated Eagle Ford position is now approximately 585,000 gross acres (335,000 net to Sanchez Energy). The contiguous nature of the acquired acreage relative to our Catarina asset creates an opportunity for significant operational and cost synergies.”

Full Year Highlights

- Acquisition of 65,000 acres in the oil window of the Western Eagle Ford, and 45,000 acres in the dry gas window of the Western Eagle Ford

- Total 2016 production of 19.5 million barrels of oil equivalent (“MMBoe”)

- Drilling and completion costs during 2016 at Catarina and Maverick averaged approximately$3.0 million per well

- Full year 2016 revenues were approximately $431 million

In December, Sanchez closed on two deals involving Eagle Ford assets valued at over $600 million. These transactions are expected to add an average of 700 Boe/d of production in 2017. Sanchez Production Partners acquired a 50% interest in Carnero Processing, LLC from Sanchez Energy Corporation for $80 million including. Carnero Processing is currently constructing a cryogenic natural gas processing plant in La Salle County.

EOG Still Seeing Potential in the Eagle Ford

EOG in the Eagle Ford

EOG Resources credits its Eagle Ford activity as a major factor for expected 18% oil growth during 2017.

Related: Eagle Ford Leads Texas in Gas Production

EOG released forth quarter and full 2016 results this week, along with spending predictions for the rest of 2017.

The company expects that capital expenditures for 2017 will range from $3.7 to $4.1, with 81% dedicated to exploration and development. Continued growth is predicted from EOG's major basins including the Eagle Ford Shale.

Eagle Ford Operations

EOG achieved strong results in the Eagle Ford during 2016 and executives say the region still holds lots of potential. The company characterized the region as their large 'laboratory' that they are using to experiment with new technological innovations.

Eagle Ford highlights include:

- Completed 75 wells in the Eagle Ford with an average treated lateral length of 5,700 feet per well

- Initial production rates per well of 1,190 Boed, or 990 Bopd, 85 Bpd of NGLs and 0.7 MMcfd of natural gas

- Crude oil production declined 8% year-over-year due to 28% reduction in well completions

- Production is expected to grow during 2017

- Will average 7 rig operating in 2017

- Lowering well costs due to innovations

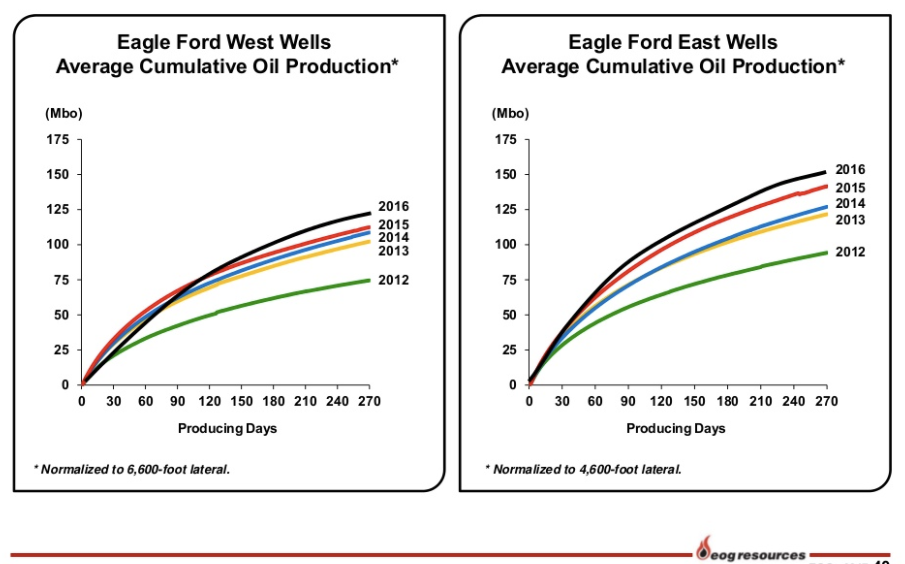

“The Eagle Ford has seen consistent year-over-year improvements in both production performance and operational efficiencies that have been the hallmark of EOG’s advancements in horizontal technology. We continue to test multiple targets and spacing patterns to determine the optimal development pattern for each area of the field. The wells completed in 2016 as a group are outperforming wells from previous years, largely as a result of the precision targeting and advanced completion designs.”

EOG's Eagle Ford Well Productivity

Eagle Ford Leads Texas in Gas Production

Eagle Ford Natural Gas Production

The Texas Railroad Commission (RRC) released its preliminary full year production numbers for 2016, showing the Eagle Ford Shale the biggest producer of natural gas in Texas.

Related: EIA Expects Gas Production to Decline

The Eagle Ford Shale leads Texas in natural gas production, according to the RRC. For full year 2016, the state's regulatory agency reported total gas production at 7,969,918,341 (mcf). This figure is broken down by region to include:

- Eagle Ford Shale: 5357 (MMcf)

- Permian Basin: 5193 (MMcf)

- Barnett Shale: 3775 (MMcf)

- Haynesville : 887 (MMcf)

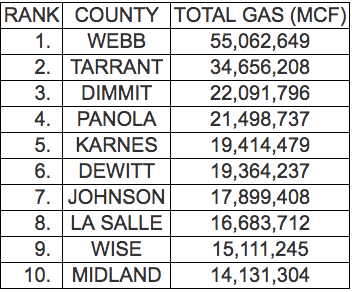

For December, 2016, Webb County was the top producing Texas county. The chart below shows the top 10 in the state, with five being in the Eagle Ford.

The EIA recently announced it expects the trend to slow and that natural gas production in the Eagle Ford will decline in March by 25 MMcf/d to almost 5.6 Bcf/d, its lowest level since November 2013. Natural gas production from the other big shale basins is projected to increase to a record high 49.1 billion cubic feet per day (Bcf/d) in March.

Eagle Ford Oil Production to Rise While Gas Decreases

Eagle Ford Oil Production - March 2017

The Eagle Ford Shale will experience production increases in March for oil, but natural gas will decrease, according to the U.S. Energy Information Administration's (EIA).

Related: Texas Rig Count Rises, Eagle Ford Gains One

Oil production in the Eagle Ford has not risen since 2015, but that should change this quarter, according to the EIA. In its drilling productivity report, the agency expects that production for the region will rise by 14,000 bbl/d to 1.08 MMbbl/d in March.

While oil production will rise, natural gas production in the Eagle Ford will decline in March by 25 MMcf/d to almost 5.6 Bcf/d, its lowest level since November 2013. Natural gas production from the other big shale basins is projected to increase to a record high 49.1 billion cubic feet per day (Bcf/d) in March.

EIA also said producers drilled 760 wells and completed 668 in the biggest shale basins in January, leaving total drilled but uncompleted wells (DUCs) up 92 at 5,381, the most since April.

A total of 753 oil and gas rigs were running across the United States this week, 11 more than last week. 153 rigs targeted natural gas (4 more than the previous week) and 597 were targeting oil in the U.S. (six more than the previous week). The remainder were drilling service wells (e.g. disposal wells, injection wells, etc.) 378 of the rigs active in the U.S. were running in Texas.