Cabot Oil & Gas announced results from the company's first horizontal well in the Pearsall Shale and the short lateral yielded promising results. The well, drilled in Frio County, produced 1,400 boe/d, with 50% of production attributable to oil. One additional Pearsall well is being completed and three others are at some stage of being drilled. A total of 6 wells will be drilled targeting the play in 2012. The first well came in at a cost of just over $10 million, but the company is targeting $9-$9.5 million for its early wells.

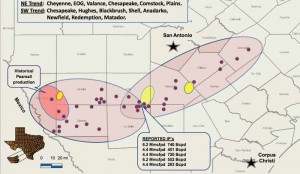

In the Eagle Ford, the company completed one well in the quarter that came online at more than 1,000 boe/d, 95% oil. There are now 38 producing wells in the Buckhorn area in Frio County, TX. Well costs have fallen to $6.5-$7 million.

Eagle Ford oil price realizations improved to more than $8 per barrel better than NYMEX pricing in the quarter. Oil is moving by pipe instead of truck to Corpus Christi, where the company is able to get LLS prices.

For 2013, approximately 30% of the company's capital budget will be allocated to the Pearsall and Eagle Ford shales of South Texas. Impressively, Cabot expects to drill into 2013 targeting gas wells in the Marcellus and Pearsall that keep the company cash flow positive at a $3.50 gas price.

"This year has seen many new ideas and ongoing efforts come to fruition, including a joint venture with an international company and innovations with well and frac spacing in key plays, that have translated into continued industry-leading production growth," said Dan O. Dinges, Chairman, President and Chief Executive Officer.