PetroQuest Energy, Inc. (NYSE: PQ) announced the completion of its Eagle Ford assets sale at the end of September, 2014. The Houston, TX-based company netted $9.7 million from the deal.

PetroQuest estimates the operating cash flow generated from its Eagle Ford assets during the first six months of 2014 totaled ~$2-million on average with daily production of ~195 boe/d. At the end of June, the company estimated proven natural gas reserves associated with the assets totaled approximately 2.1 Bcfe, with an estimated discounted net cash flow (PV-10*) of $6.6-million.

Overall, this sale a good deal for PetroQuest, considering the purchase price was nearly 50% higher than PV-10. The company did not disclose the buyer for the assets.

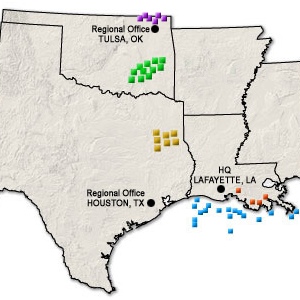

PetroQuest will likely re-invest the proceeds from this sale in another Texas play. The company's core focus areas are in the Woodford, Cotton Valley and the Gulf Coast.

PV-10: present value of estimated future oil and gas revenues, net of estimated direct expenses, discounted at an annual discount rate of 10%.

Read more at petroquest.com