The "good ol' days" for the oil and gas industry are back in Texas! The Energy Information Administration (EIA) recently released data showing the state produced just over 3 million b/d of crude oil in April of 2014, reaching production levels not seen in the state since the 70s.

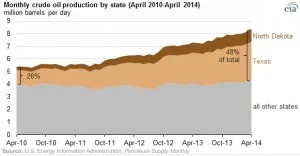

Many Texans remember well the oil bust of the early 80s, when the price of oil fell drastically, and what followed was a blight on the states' economy. A steady decline in oil production, which began in 1972, and fell sharply after the bust, signaled the state's oil boom days were likely over for good. But now Texas along with the rest of the U.S. is on track to become the top oil producer in the world by 2015, according to the International Energy Agency (IEA). The EIA said in the month of April, Texas and North Dakota, which encompasses the prolific Bakken Shale play, made up nearly half of U.S. oil production (48%).

The rise in Texas' oil production is thanks in large part to the tight oil and shale gas revolution in the Eagle Ford, and made possible by advancements in horizontal drilling and fracking technology. The Permian Basin in West Texas, a major oil producing area in the state for years, has also seen an increase in horizontal drilling since the end of 2013, and many of the areas untapped oil reserves are being accessed by the technology.

Read more: Why Horizontal Drilling is Important to Texas Oil Production

Texas Surpasses Iraq's Oil Production

The EIA's data is yet another indication of America's re-emerging prominence as a leader in world-wide oil production. In June of 2014, Iraq's production fell 400,000 b/d to 2.9 million, due to violence and civil unrest flaring up in the country, according to Bloomberg. That means Texas has likely surpassed Iraq's oil production, since Texas' production has increased on a month-to-month basis since 2011. Iraq was rated as the second largest OPEC producer in April at 3.2 million b/d.

Read more at bloomberg.com