The Eagle Ford Shale rig count decreased by two rigs to average 267 running over the past week. Operators largely have development plans in place through the remainder of the year, but don't be surprised to see additional rigs from companies who benefit from $110 oil.

We also highlighted news this week the Eagle Ford came out on top in another list. PWC ranked the Eagle Ford as the most active area for deals in the second quarter. The deal market has been slower across the board, but assets are still changing hands in South Texas. Read more in the article Eagle Ford Region Most Active For Deals. PWC ranked the Eagle Ford, Bakken, and Marcellus as the top three areas for deals.

The U.S. rig count fell nine rigs to 1,767 and more rigs moved to drilling natural gas. A total of 394 rigs are targeting natural gas and 1,365 are targeting oil in the U.S. The remainder are drilling service wells (e.g. disposal wells, injection wells, etc.). 838 rigs are running in Texas.

Baker Hughes rig count is quoted here. Baker Hughes also releases its own Eagle Ford Rig Count that covers the 14 core counties (~231 rigs). The rig count published on EagleFordShale.com includes a 30 county area impacted by Eagle Ford development. A full list of the counties included can be found in the table near the bottom of this article.

Eagle Ford Oil & Gas Rigs

[ic-l]The natural gas rig count decreased by 1 to 43 rigs. With the spread of oil prices to natural gas widening, I don't expect to see a big jump in natural gas activity in the $3.50/mcf price range. Natural gas futures were trading around $3.50/mmbtu on Friday afternoon.

The oil rig count decreased by one rig to 223 running in the region. WTI oil prices were trading above $110/bbl and have held above $100 for nine weeks. Oil prices have been above $100 long enough we'll likely begin seeing operators react to higher cash flow. Generally, there's a lag of 60-90 days before operators react to significant commodity price changes. Expect to see operators add rigs in the region or pay down debt. Eagle Ford light crude traded at $104.75/bbl on Sept 5th.

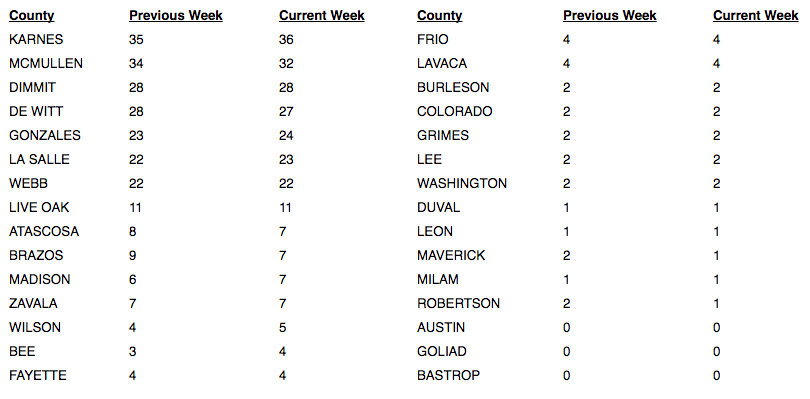

A total of 220 rigs are drilling horizontal wells, 32 rigs are drilling directional wells, and 15 rigs are drilling true vertical wells. Karnes and McMullen counties lead development with 36 and 32 rigs running, respectively. See the full list of drilling by county below.

South Texas Oil & Gas News:

- EP Energy Planning IPO

- Matador Resources Issues Stock To Fund Eagle Ford Development

- NGL Energy Spends $116 Million On Eagle Ford Disposal Assets

- Aqueous Services Looks To Lead The Way In Water Management - Press Release

- Eagle Ford Region Most Active For Deals - PWC

Be sure to visit our South Texas Oilfield Job Listings to search openings and come back weekly for updates or sign up for alerts - Daily or Weekly Email Alerts

Eagle Ford Shale Drilling by County

Eagle Ford Operated Rig Count By Company

SmithBits no longer reports its operated rig count, but we'll have updated number for you from a new source soon. Until then, you can reference our numbers from mid-April. There has not been a significant change in the overall rig count since this date:

What is the Rig Count?

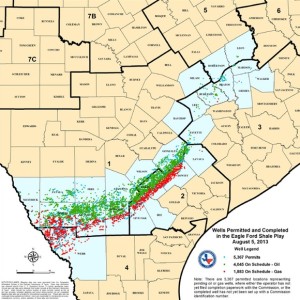

The Eagle Ford Shale Rig Count is an index of the total number of oil & gas drilling rigs running across a 30 county area in South Texas. The South Texas rigs referred to in this article are for ALL drilling reported by Baker Hughes and not solely wells targeting the Eagle Ford formation. All land rigs and onshore rig data shown here are based upon industry estimates provided by the Baker Hughes Rig Count and/or Smith Service Co's (Schlumberger) Smith Rig Count.