Shale exploration technologies have initiated a renaissance for domestic applications for natural gas that include power generation, manufacturing and vehicle fuel, but also the growing prospect for export. Yet the possibility of exporting natural gas remains controversial. For example, several chemical companies have formed an advocacy group known as America’s Energy Advantage that is attempting to exert political pressure to limit exports.

Exporting Domestic Natural Gas Is Attractive At International Prices

It’s not hard to see why exporting natural gas is an attractive proposition. At present, global natural gas markets are not integrated. Prices vary from $0.75 per thousand cubic feet in Saudi Arabia, to $3-4 in the U.S. to around $12 in Europe, and as high as $16-17 in Japan. This situation is based on short-term shifts in supply and demand which have created export arbitrage opportunities,[1] which will be systematically exploited.

LNG Liquefaction Needed

In order to ship natural gas abroad from the U.S. efficiently, it must be supercooled to minus 260 degrees Fahrenheit near an export terminal at a deepwater port and transformed into LNG, which reduces its volume by more than 600 times. An LNG tanker then transports the product to its designated foreign market. When the LNG reaches its destination, it is revaporized (or regasified) back into a gas before being shipped to its final destination by pipeline. Each step in this process is significant in terms of operating costs.[2]

“Given the current worldwide price differentials, it is profitable to ship LNG to Japan from the U.S.”

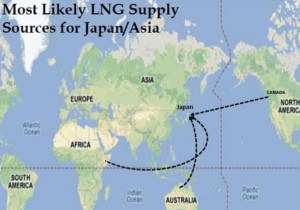

For example, given the current worldwide price differentials, it is profitable to ship LNG to Japan from the U.S. Assuming a U.S. market price of $4 per thousand cubic feet, there is the additional cost of approximately $6.40 to liquefy, transport and regasify at the delivery point in Japan – more than doubling the price. Even so, a healthy profit of $6.60 for every thousand cubic feet is still generated.[3] However, this lucrative opportunity will not go unnoticed by Australian, East African and even Canadian natural gas suppliers – all of whom have substantial natural gas reserves and are equally or better positioned logistically to ship to Japan than is the U.S.

Similarly, prices in Europe have remained artificially high because of Russia’s Gazprom monopoly on natural gas exports. With the threat of LNG imports from the U.S., the Ukraine and other countries[4], prices in Europe are unlikely to remain at current levels either. Further, Gazprom’s pipeline monopoly is already under siege from domestic producers in Russia, such as Novatek and Rosneft, and Statoil in Norway.[5]

In short, markets are dynamic. While there is an attractive export opportunity in the near term (3-5 years) for U.S. producers, over the longer term supply will catch up with demand and reduce global price differentials.[6]

A Global Market For Natural Gas Will Evolve

[ic-l]The eventual synchronization of supply and demand will serve to both moderate the demand for exports from the U.S., as well as put downward pressure on natural gas prices.[7] In the same way that crude oil has become a global market, so will natural gas. This will come about as a direct result of new, significant natural gas discoveries and eventual production in the U.S., Australia, East Africa and probably China – perhaps other countries as well. These countries will seek to export their surplus, or in the case of China, reduce their need to import. Taken as a whole, these new supply markets that extend well beyond U.S. borders will serve to keep a cap on natural gas prices at an estimated $4-7 per thousand cubic feet (and arguably in a tighter range between $5-6).[8] This kind of price stability would indeed represent a significant shift away from the frequent spikes that occurred during the era of conventional natural gas exploration and production, which is steadily giving way to unconventional methods of production.

[1] Energy Information Administration. “Effect of Increased Natural Gas Exports on Domestic Energy Markets.” U.S. Department of Energy. January 2012.

[2] Kawamoto, Lt. Hannah. “Natural Gas Regasification Technologies,” USCG Proceedings, Winter 2008-09.

[3] Henderson, James. “The Potential Impact of North American LNG Exports.” The Oxford Institute for Energy Studies.

[4] Peaple, Andrew. “A New Foreign Policy for Gazprom.” Heard on the Street,The Wall Street Journal. January 29, 2013.

[5] Marson, James. “Gazprom warns of a drop in profit, driving down stock” The Wall Street Journal. Feburary 11, 2013.

[6] Medlock III, Ph.D., Kenneth B., “U.S. LNG Exports: Truth and Consequence.” James A. Baker III Institute for Public Policy, Rice University. August 2012.

[7] Henderson, James. “The Potential Impact of North American LNG Exports.” The Oxford Institute for Energy Studies, from the Preface by Howard Rogers.

[8] Henderson, James. “The Potential Impact of North American LNG Exports.” The Oxford Institute for Energy Studies and UTSA Center for Community and Business Research estimates.