Sanchez Energy

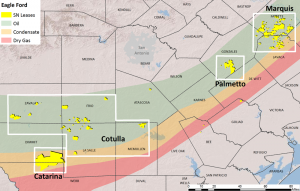

Sanchez Energy has approximately 226,000 net leasehold acres in the liquids-rich Eagle Ford play as of December 31, 2014. The company's Eagle Ford positions are in various stages of development. In Cotulla and Palmetto, operations are focused on optimizing the number of wells and driving down well costs. And in the area of Marquis, they have commercially extended the Eagle Ford trend through appraisal and well design optimization.

As of December 31, 2014, Sanchez is producing in or operating 485 gross producing wells, while 52% of their proved reserves were undeveloped. In 2015, they invested 95% of our upstream capital to drilling our liquids-rich inventory of high quality prospects in the Eagle Ford.

Sanchez Energy Corporation (NYSE: SN) is an independent exploration and production company focused on the acquisition and development of unconventional oil and natural gas resources in the onshore U.S. Gulf Coast, with a current focus on the Eagle Ford Shale.

Eagle Ford Shale Oil & Gas Discussion Forum

Join the Eagle Ford Discussion Group today - your voice counts!

MineralRightsForum.com is a discussion network for mineral owners, royalty owners and industry professionals to discuss oil & gas related topics.

Counties Where Sanchez is Active

- Colorado County

- DeWitt County

- Dimmit County

- Fayette County

- Frio County

- Gonzales County

- Karnes County

- LaSalle County

- Lavaca County

- Zavala County

Sanchez Eagle Ford Shale Quarterly Commentary

Press Release

February 2016

Sanchez Energy ended 2015 with record production in the Eagle Ford and $435 million in cash, despite the difficult downturn. 2015 Eagle Ford Highlights include:

- Expanded inventory in our Catarina and Cotulla assets.

- Increase well performance through advancements in our completion designs

- Reduced well costs by more than 55%

- Catarina and Cotulla were now delivering total well costs of less than $3.5 million

- Record production of 5.3 million barrels of oil equivalent (“MMBoe”)

- Phase 1 of the high-pressured gas gathering line is scheduled to be in service near the end of the first quarter

- Construction of the gas processing plant has also started and is still on track for an estimated completion in early 2017

In 2016, Sanchez has set a capital expenditure budget between $200 million to $250 million and plans to spend 89% on drilling and completions in the Eagle Ford. The company also plans to drill 52 net wells and complete 55 net wells in the region. The company expects to reduce the Eagle Ford rigs from three to one at the end of the second quarter.

November 2015

In a third quarter earnings call last week, Sanchez Energy reported a net loss of $421 million while boasting cost reductions and increased production.

CEO Tony Sanchez acknowledged that the downturn is proving challenging, but that he believes the company has been performing exceptionally well. He emphasized that the company is positioning itself for even better performance once the market recovers.

Sanchez reported substantial cost savings due to the company’s supply chain initiatives, process improvements and a reduction in production costs by a $1 per BOE this year. The company also reduced costs for its recent pads to below 4 million each, representing a significant reduction in total costs relative to 2014.

Catarina remains Sanchez’ focus in the Eagle Ford, with the Company planning to average two gross (two net) rigs for the remainder of 2015. In the third quarter 2015, the Company brought 27 gross (26.5 net) operated wells online. Other highlights include:

- Joint ventures with a midstream partner to enhance the marketing capability at Catarina

- Preliminary 2016 upstream capital spending guidance of $250 million to $300 million

- During the third quarter, the company brought 27 gross operated wells, 26.5 net

- Have a total of 592 gross producing wells online with 30 wells currently in the process of waiting on completion

September 2015

In a press release, Sanchez confirmed that it is selling approximately 150 miles of midstream gathering lines and associated midstream infrastructure in the Eagle Ford in order to gain much-needed cash. Sanchez Production Partners will acquire and operate the assets concentrated in four gathering and processing facilities. Both firms are run by the private Sanchez Oil & Gas Corp.

The sale is expected to close next month and will bring Sanchez $618 million cash on hand, which they will use to buy assets, lease more property and accelerate drilling. The company anticipates that this agreement will result in an increase in lease operating expense of approximately $1.95 per barrel of oil equivalent.

August 2015

In their Q2 earning call, they reported a total production of 4,907 thousand barrels of oil equivalent (“MBOE”), a 164% increase over the second quarter 2014 he company announced it has reduced 2015 capital spending estimate by $50 million or approximately 8% and now plan to spend between $550 million and $600 million.

Tony Sanchez, III, President and Chief Executive Officer of Sanchez Energy commented ‘ we have positioned the company to both thrive and grow in a $40 to $50 oil price environment. Improvement in our cost structure and production performance has allowed us to do more with less”

The Company’s Eagle Ford development plan remains primarily focused on Catarina, where the Company plans to average four gross (3.5 net) rigs over the course of 2015. Other Eagle Ford highlights include:

- We are currently ahead of schedule on our development program in the Eagle Ford. In Catarina we exceeded our first annual 50-well drilling commitment by drilling 68 wells, which allows us to bank 18 wells toward the next annual commitment period that ends in June of 2016.

- In the process of completing our first pad in North Western Catarina,

- Bought 35 gross wells online during the quarter

- Currently has 565 gross producing wells with 32 gross wells in various stages of completion

May 9, 2012

Our log of the vertical pilot hole in Marquis, our Prost #1H well, confirmed our expectations with respect to the targeted productive section in the Eagle Ford and indicated a productive Austin Chalk zone immediately above the Eagle Ford which can be targeted in the fracture stimulation of the Eagle Ford. After completing the horizontal section of the Prost #1H well, the rig will skid over to drill the Prost #2H well which will not require a pilot hole. We expect first production results from these two wells in late June.

Our drilling activities in Maverick are well on track with our plans and we expect to have three horizontal wells on production here by the end of the second quarter, with a fourth horizontal well reaching TD near the end of the quarter. Our vertical Mark & Sandra #1V well has produced initial production results that have exceeded our expectations. We have recently run tubing and installed pumping equipment on the well and are now in a position to judge the sustained production results. We will shortly spud a second vertical well, the Goodwin #1V, and we plan to test a gas frack of the Eagle Ford section in that well. Over the course of this year we will continue our assessment of a vertical development program in Maverick as a supplement to our ongoing horizontal wells.

Source: Sanchez Energy Corporation