Noble Energy Raises 2017 Capex by 63%

Noble Energy has announced they will raise 2017 capital expenditures to between $2.3 to $2.6 billion, with $325 MM earmarked for the Eagle Ford.

Related: Noble energy Adds Eagle Ford Rig

Noble announced fourth quarter and full year 2016 results this week, alongside a 63% increase in 2017 CAPEX.

Eagle Ford Operations

Production for Noble's Eagle Ford assets during the quarter was impacted by an in-field gathering pipeline mechanical issue leading to approximately 3 MBoe/d of curtailments on average during the quarter. Quarterly highlights include:

- Sales volumes averaged 46 MBoe/

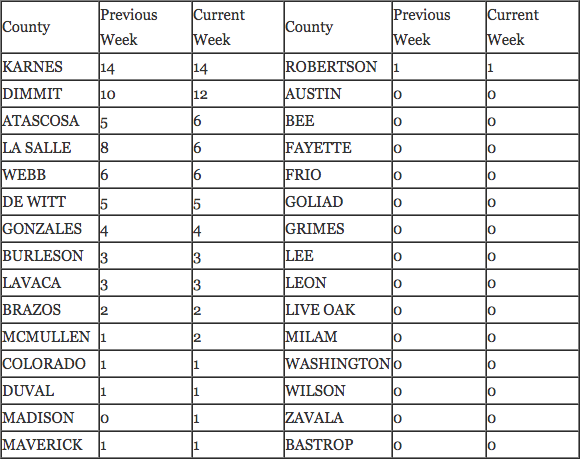

- Drilled fourteen wells to total depth within the quarter

- Commenced production on six Lower Eagle Ford wells

- Company brought on production its initial operated Upper Eagle Ford well

- Two operated rigs and 30 wells drilled but uncompleted at the end of 2016

“Building on our strong performance over the last couple of years, Noble Energy is now rapidly accelerating our pace of development in 2017. In the U.S. onshore business, we are materially increasing the capital allocation to each of our liquids-focused assets in 2017, including the DJ Basin, the Delaware Basin, and the Eagle Ford.”

2017

Looking forward to the rest rest of 2017, Noble plans to spend $2.3 to $2.6 billion an increase of approximately 63% from 2016 levels. Approximately 75% of the 2017 total capital program will be aimed at drilling and completion activities opportunities in the DJ Basin, Delaware Basin, and Eagle Ford.

Noble Energy’s total U.S. onshore rig count is expected to average more than eight operated rigs for 2017, exiting the year with nine. Currently, the company plans to average one rig program in the Eagle Ford.

The company's Eagle Ford program for 2017 will be focused on Lower Eagle Ford wells in Gates Ranch, with additional plans for multiple Upper Eagle Ford wells.