Texas Earthquake Risk

An oil and gas lease sale in Texas is being threatened by environmentalists and the fear of earthquakes.

Related: Texas on Short List for Fracking-Induced Earthquakes

The Bureau of Land Management has scheduled an auction for oil and gas leases on federal land in Texas for April, 2017. But several environmental groups are asking the agency to reconsider and withdraw the proposed lease sale, which includes 3,100 acres beneath dams that store water supplies for Corpus Christi and Brenham.

A joint letter sent by The Center for Biological Diversity, Clean Water Action and Sierra Club voiced concerns that fracking might trigger earthquakes that could harm the dam infrastructure and threaten the water source for half a million Texans.

“We insist that BLM: (1) cease all new leasing of fossil fuels in the planning area, including oil and natural gas; or, at a minimum (2) withdraw the proposed April 2017 sale pending a programmatic review of all federal fossil fuel leasing which must consider a ‘no leasing’ and ‘no fracking’ plan amendments.”

The letter also cites criticism of the current Environmental Assessment, saying it is “unlawfully deficient”. The group insists that if the BLM continues with the sale, they should do the following:

- 1) Initiate formal consultation with the Fish and Wildlife Service, as required by the Endangered Species Act (“ESA”)

- 2) Prepare a full EIS for the proposed lease sale that considers a full range of alternatives, including an alternative that bans new hydraulic fracturing and other unconventional well stimulation activities, and require strict controls on natural gas emissions and leakage

The topic of fracking and earthquakes in Texas has continued to be controversial, with interests on both sides citing scientific evidence that supports their claims. The Texas Railroad Commission continues to be skeptical of the link between fracking and earthquakes and has publicly questioned the mounting scientific evidence of the link.

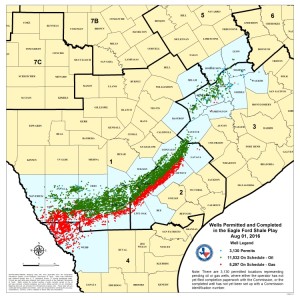

In April, The U.S. Geological Survey (USGS) released a forecast for 2016 that include maps identifying potential seismic events from both human-induced and natural earthquakes. According to the maps, the Eagle Ford shows a less than 1% chance of any type of seismic activity, either manmade or natural.