In December of 2011, the Federal Motor Carrier Safety Administration published a final rule for hours of service (HOS) that is scheduled to go into effect on July 1st 2013 regardless of a pending lawsuit that was submitted by American Trucking Associations.

This is not the first time the FMCSA has changed HOS regulations and it’s not likely to be the last. How long drivers should work before taking a break is a bone of contention among several parties. Safety activists want shorter work periods and longer, more frequent rest breaks while those in the industry want to make the most of their time on the road. In an effort to arrive at the best solution, regulations have been changed only to be changed back.

The HOS “Merry Go Round” has been a thorn in trucking’s side for years and has cost the industry millions of dollars to update paperwork, policies and conduct training workshops so employees will be in compliance. As publishers of training materials, we at Mike Byrnes and Associates, Inc., scramble to bring our publications current.

Opinions will vary about the latest HOS changes but in the end we all have to comply with the regulations in force.

Here’s a summary of the changes that go into effect July 1st, 2013:

Limitations on minimum "34-hour restarts"

- Current rule states:

- there are no limits on how many 34-hour restarts you can use in a 7 day work week.

- The new rule states:

- Must include two periods between 1 a.m. - 5 a.m. home terminal time.

- May only be used once per week.

Rest breaks

- Current rule states:

- there are none except as limited by other rule provisions

- The new rule states:

- May drive only if 8 hours or less have passed since end of driver's last off-duty period of at least 30 minutes. [HM 397.5 mandatory "in attendance" time may be included in break if no other duties performed]

Here’s also a summary of the changes that went into effect February 27th, 2012:

On-duty time

- Current rule states:

- anytime a driver is in Commercial Motor Vehicle, except sleeper-berth.

- The new rule states:

- Does not include any time resting in a parked vehicle (also applies to passenger-carrying drivers). In a moving property-carrying CMV, does not include up to 2 hours in passenger seat immediately before or after 8 consecutive hours in sleeper-berth.

Penalties

- Current rule states:

- "Egregious" hours of service violations not specifically defined.

- The new rule states:

- Driving (or allowing a driver to drive) more than 3 hours beyond the driving-time limit may be considered an egregious violation and subject to the maximum civil penalties. Also applies to passenger-carrying drivers.

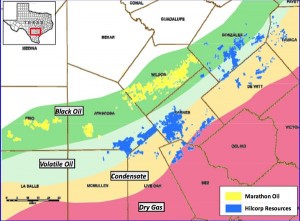

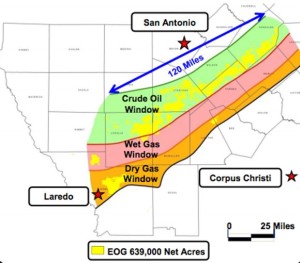

Oilfield exemption

- Current rule states:

- "Waiting time" for certain drivers at oilfields (which is off-duty but does extend 14-hour duty period) must be recorded and available to FMCSA, but no method or details are specified for the record keeping.

- The new rule states:

- "Waiting time" for certain drivers at oilfields must be shown on logbook or electronic equivalent as off duty and identified by annotations in "remarks" or a separate line added to "grid."

Making It Work

Next month, in Part Two, we’ll take a look at how to manage the new hours of service regulations.

Quick Reference HOS Regulations

HOURS-OF-SERVICE RULES

Property-Carrying CMV Drivers (Valid Until July 1, 2013)

Passenger-Carrying CMV Drivers

11-Hour Driving Limit

May drive a maximum of 11 hours after 10 consecutive hours off duty.

10-Hour Driving Limit

May drive a maximum of 10 hours after 8 consecutive hours off duty.

14-Hour Limit

May not drive beyond the 14th consecutive hour after coming on duty, following 10 consecutive hours off duty. Off-duty time does not extend the 14-hour period.

15-Hour On-Duty Limit

May not drive after having been on duty for 15 hours, following 8 consecutive hours off duty. Off-duty time is not included in the 15-hour period.

60/70-Hour On-Duty Limit

May not drive after 60/70 hours on duty in 7/8 consecutive days. A driver may restart a 7/8 consecutive day period after taking 34 or more consecutive hours off duty.

60/70-Hour On-Duty Limit

May not drive after 60/70 hours on duty in 7/8 consecutive days.

Sleeper Berth Provision

Drivers using the

sleeper berth provision

must take at least 8 consecutive hours in the sleeper berth, plus a separate 2 consecutive hours either in the sleeper berth, off duty, or any combination of the two.

Sleeper Berth Provision

Drivers using a

sleeper berth

must take at least 8 hours in the sleeper berth, and may split the sleeper-berth time into two periods provided neither is less than 2 hours.