At the annual Benposium Conference in Houston, TX, in early June of 2014, the Eagle Ford ranked highest for internal rate of return* (IRR) among all other U.S. Shale plays. According to Bentek Energy Senior Analyst Catherine Bernardo, the Eagle Ford is sitting at just over 70% IRR. Compare that to a 20% IRR, which Bernardo said is generally the rate at which producers move rigs into plays.

As development in the Eagle Ford continues, drilling efficiency is a primary goal for producers. According to Bernardo, the average number of drilling days has decreased 34% from 23 days to 15 days between 2010 - 13.

Small Eagle Ford Producers May Feel the Pinch by End of the Decade

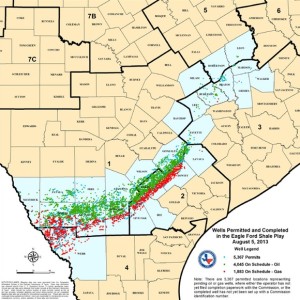

The Eagle Ford is a very oily play, and with the price of oil over the $100/bbl mark, drilling is very active in the area. EagleFordShale.com tracks activity in the Eagle Ford, and currently, there are 269 rigs running across our coverage area. In the years to come however, small producers in the Eagle Ford Shale may feel the pinch as the price of oil begins to fall.

Read more: Eagle Ford Shale Rig Count Increases by Seven to 269

“Bentek predicts the price of crude oil will fall to $82 by 2018 - 19... That will have some cash flow impact on the smaller producers from being as low as that.”

Bernardo continued, saying that its not until oil falls between $80 and $60 dollars does it become uneconomic for some producers.

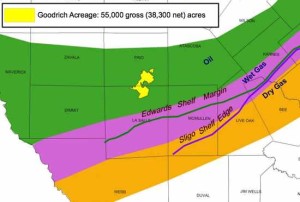

Tight Oil vs. Shale Gas

While the Eagle Ford Shale is proving to be very lucrative for producers, unconventional gas plays like the Haynesville Shale in Louisiana, are not seeing as much activity, with an IRR of just over 20%. The primary reason is attributable to the price of natural gas, which is around $4.50/mmbtu.

Producers will need to see gas prices go up and stabilize in order to have confidence in re-entering U.S. shale gas plays. Between 2010 - 11, the rig count in the Haynesville Shale was close to 140; however, the price of natural gas at that time was around $12/mmbtu.

Bentek’s annual Benposium conference is held in Houston each Spring.

internal rate of return (IRR)* - IRR calculations are used to evaluate the desirability of investments or projects. The higher a project's IRR, the more desirable it is to undertake the project.