Repsol completed its acquisition of Talisman Energy last month and became one of the largest companies in the energy sector worldwide.

Related: Talisman Energy Cuts Jobs

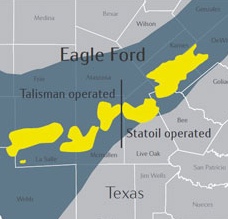

The deal brings Repsol into the Eagle Ford and allows them to gain 59,000 net acres of south Texas land. It is still unclear how this merger will affect those Eagle Ford shale operations. In a conference call on May 10th, Repsol said that Talisman’s assets had been consolidated into its upstream division, but they were not ready to reveal further details about their plans.

The announcement comes days after Talisman released strong first quarter results.

“Talisman delivered solid operational and financial results in the first quarter of 2015 against a backdrop of significantly lower commodity prices and our strategic decision to cut capital investment,’ said Hal Kvisle, President and CEO. ‘Production from ongoing operations averaged 360,000 boe/d in the quarter, up slightly from the first quarter of 2014, and cash flow(1) was $605 million for the quarter, supported in large part by hedging settlements.”

First Quarter Highlights:

- Production averaged 360,000 boe/d in the first quarter of 2015, up 2% from the first quarter of 2014.

- Cash flow was $605 million, up 19% from the previous quarter

- Capital spending was $436 million, down 48% from last quarter and 43% from the first quarter of 2014

- Operating cost was $439 million, down 17% from the previous quarter and 15% from the first quarter of 2014.

Read more at repsol.com