Magnum Hunter (MHR) has granted New Standard Energy, an Australian company, the option to acquire Pearsall Shale and Eagle Ford Shale assets in Atascosa County.

New Standard paid $75,000 for the option and will pay an additional $15 million in cash and $9.5 million in equity.

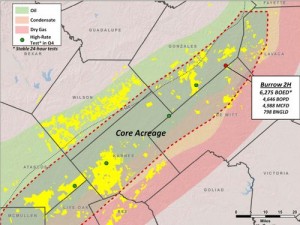

In total, Magnum Hunter will receive a little less than $25 million for ~5,200 net acres and 300 boe/d of production from five wells. New Standard has until January 21, 2014, to exercise the option.

Read more:Penn Virginia - Magnum Hunter Reach Eagle Ford Deal Worth $400 Million

The deal is part of ~$700 million in divestitures that will allow the company to focus on development of assets in the Marcellus and Utica shales.

“Our ability to grow both production and reserves at the highest internal rate of return within our existing asset base, undoubtedly lies in our acreage position located in the Utica and Marcellus Shale resource plays.”

Also read:Magnum Hunter Completes PVA Deal - Still Targeting the Eagle Ford and Pearsall

Magnum Hunter plans to spend $400 million in 2014, with $260 million allocated in the Utica and Marcellus, $50 million planned in the Bakken, and $90 million spent on midstream infrastructure.

If the option is exercised by New Standard Energy, this deal likely ends Magnum Hunters upstream activity in the Eagle Ford and Pearsall completely.

Read more at sec.gov