With the recent dip in oil prices, Clayton Williams indicated it may be scaling back drilling plans in the Eagle Ford in 2015.

Currently, the company is running a six rig program across its core areas, with three in the Eagle Ford and three in the Delaware Basin, and plans to continue drilling at this pace for the remainder of 2014. Based on this level of activity, the company expects combined oil and gas production for the fourth quarter of 2014 to average between 16,600 and 17,000 boe/d portfolio-wide.

By comparison, Clayton Williams estimates the same number of rigs in the Eagle Ford and Delaware Basin, would yield an average between 18,800 and 19,400 boe/d portfolio-wide in 2015. However, officials indicated in the company's third quarter of 2014 report that a two rig drilling program may be considered in each area, which would reduce production by 1,300 boe/d.

In the third quarter of 2014, the Eagle Ford alone averaged approximately 2,900 boe/d, with a 94% oil cut.

Clayton Williams' Eagle Ford Operations Update - Q3 2014

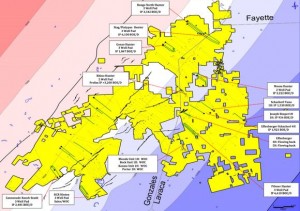

Currently, Clayton Williams has 22 horizontal Eagle Ford wells on its legacy Austin Chalk acreage block in Burleson, Robertson and Lee Counties, that have been on production for 30 days or more. The peak 30-day production rate for these wells has averaged 518 boe/d, with a 96% oil cut. Six additional wells have been on production for less than 30 days or are currently in various stages of completion, and three wells are currently being drilled. Typical drilling and completion costs in this area range from $5-million to $6-million per well, according to company officials.

Clayton Williams Testing Sequential Fracturing Operations and Well Densities

Clayton Williams is currently testing sequential fracturing operations and increased well densities, primarily in Burleson County, to help determine optimal spacing and fracturing design for future Eagle Ford development. Company officials say two adjacent wells were sequentially fractured with good early results, and there are plans for the fourth quarter to sequentially fracture a group of three adjacent wells.

Read more at ClaytonWilliams.com