After nearly four decades, the Obama administration has opened the door for U.S. exports of unrefined American oil, according to The Wall Street Journal (WSJ).

The decision was approved in a private ruling by the Commerce Department's Bureau of Industry and Security, and will for now allow only two companies, Pioneer Natural Resources Co. and Enterprise Product Partners LP, to export Eagle Ford condensate after it has been minimally processed. Shipments, which are likely to be small, could begin as early as August, the paper noted.

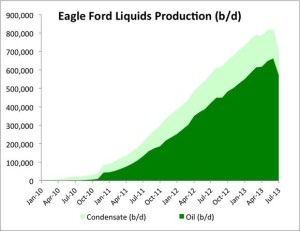

Condensate, which is also referred to as ultra-light oil, and light crude oil make up a majority of production in the Eagle Ford Shale. As a general rule, lighter crudes and condensate are easier to process into refined products.

Light-Sweet Crude/Condensate Production Booming in the Eagle Ford

With production booming in the Eagle Ford, there has been chatter for some time about the easing of the export ban, as the supply of light sweet crude/condensate has begun to saturate the market and drive prices of Eagle Ford crude down. By 2020, consultancy Wood Mackenzie estimates crude and condensate production coming out of the Eagle Ford will reach 2-million b/d, which is nearly double current production.

WSJ reports the private rulings by the Commerce Department define some ultralight oil as fuel after it has been minimally processed, making the oil eligible for sale outside of the U.S. This new ruling flirts with current rules put into place after the Arab oil embargo in the 70s, which allow U.S. companies to export refined products such as gasoline, but not unrefined products (i.e. crude and condensate), with certain limitations and special licensing provisions.

Read more at wsj.com