EOG in the Eagle Ford

EOG Resources credits its Eagle Ford activity as a major factor for expected 18% oil growth during 2017.

Related: Eagle Ford Leads Texas in Gas Production

EOG released forth quarter and full 2016 results this week, along with spending predictions for the rest of 2017.

The company expects that capital expenditures for 2017 will range from $3.7 to $4.1, with 81% dedicated to exploration and development. Continued growth is predicted from EOG's major basins including the Eagle Ford Shale.

Eagle Ford Operations

EOG achieved strong results in the Eagle Ford during 2016 and executives say the region still holds lots of potential. The company characterized the region as their large 'laboratory' that they are using to experiment with new technological innovations.

Eagle Ford highlights include:

- Completed 75 wells in the Eagle Ford with an average treated lateral length of 5,700 feet per well

- Initial production rates per well of 1,190 Boed, or 990 Bopd, 85 Bpd of NGLs and 0.7 MMcfd of natural gas

- Crude oil production declined 8% year-over-year due to 28% reduction in well completions

- Production is expected to grow during 2017

- Will average 7 rig operating in 2017

- Lowering well costs due to innovations

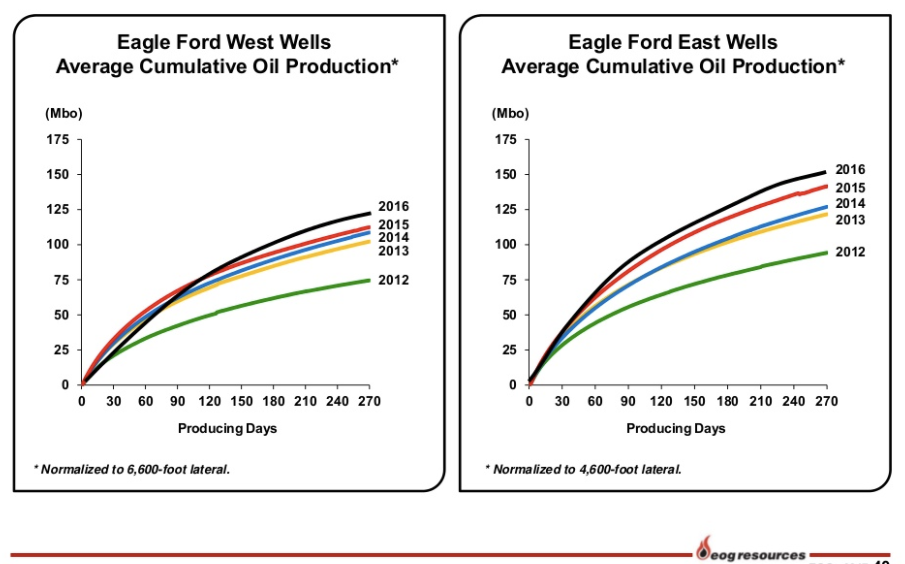

“The Eagle Ford has seen consistent year-over-year improvements in both production performance and operational efficiencies that have been the hallmark of EOG’s advancements in horizontal technology. We continue to test multiple targets and spacing patterns to determine the optimal development pattern for each area of the field. The wells completed in 2016 as a group are outperforming wells from previous years, largely as a result of the precision targeting and advanced completion designs.”

EOG's Eagle Ford Well Productivity