Penn Virginia is selling its natural gas midstream assets in the Eagle Ford to an affiliate of ArcLight Capital Partners (American Midstream) for $100 million.

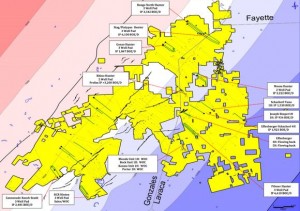

The deal includes gas gathering, a gas lift system, 119 miles of pipelines and associated facilities in Gonzales and Lavaca counties.

ArcLight has several active midstream investments and will likely make future acquisitions in the area or sell this to a larger midstream operator in the next five years.

Read more:Penn Virginia Acquires Magnum Hunter Resources' Eagle Ford Assets

ArcLight Capital has raised over $10 billion for energy related investments since 2001.

H. Baird Whitehead, CEO, stated, "The divestiture of our natural gas midstream assets is the first step in a series of potential divestitures which will reduce our indebtedness, improve our liquidity and fund further investment in our oily Eagle Ford Shale play."

Read the full press release at pennvirginia.com